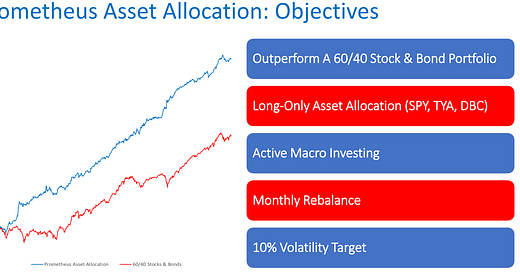

The Prometheus Asset Allocation program offers a stable, macro-focused approach to asset management. Prometheus Asset Allocation aims to outperform a traditional stock and bond portfolio by leveraging our proprietary systematic macro process to rotate between 3 ETFs monthly.

If you’re unfamiliar with our approach to macro, we have a series of notes that offer our mechanical understanding of macro conditions. You can find these Macro Mechanics notes below:

We highly recommend reviewing these notes as they form the conceptual base on which our systems are built.

Turning to our latest Asset Allocation views, our primary takeaways are below:

Prometheus Macro Monitors: Our high-frequency measures of economic activity suggest an environment that is slowing, inflationary pressures are neutral, and liquidity growth is peaking.

GDP Nowcast: GDP growth remains positive on the back of strong consumer spending.

Market Discounting: Earnings expectations are rich, inflation expectations are rich, and monetary policy expectations are fair.

Market Regime Monitors: Macro markets are consistent with rising growth, inflation, and liquidity.

Asset Class Signals: Alpha signals across assets are low, but stocks show the strongest signal amongst assets.

Allocations: SPY (44%), TYA (21%), DBC (0%), and Cash (35%).

Watch the whole video update here: