Integrating Growth, Inflation & Liquidity

Macro Mechanics + Month In Macro Sample

The best information we can ever provide investors is the mechanics of how we think about macro conditions over time rather than what we think about them at any particular time.

Consistent with this idea, we present our Macro Mechanics, a series of notes that describe our mechanical understanding of how the economy and markets work. These mechanics form the principles that guide the construction of our systematic investment strategies. We hope sharing these provides a deeper understanding of our approach and ongoing macro conditions.

Today, we will offer an analytical framework that integrates the concepts of growth, inflation, and liquidity into a single approach for thinking about macro. However, before you dive into the linkages, we highly recommend going through the individual mechanics if you haven’t already. You can click on the links listed below to read each of these notes:

Each component explained above is an integral part of the macroeconomic picture. However, the combination of these three forces defines all of macro. This is not an exaggeration; the aggregate tracking of growth, inflation, and liquidity comprises the most comprehensive approach to tracking all economic activity, from the macro income statement to the balance sheet. Let’s dive in.

The purpose of macroeconomic investment is to have a comprehensive understanding of the whole economy and to make bets on its future outcomes to create positive investment outcomes. While the whole economy is fundamentally an extremely complex system, the way people track what’s happening with it is relatively straightforward. All economic activity is represented through a series of transactions, best captured through simple accounting statements. Tracking these transactions gives us an extremely comprehensive understanding of what’s happening to the economy from multiple perspectives. We think there are three key perspectives required to have a holistic understanding of macroeconomic conditions:

Demographics: While population dynamics are not expressly accounted for in economic transactions, they are the foundation on which the entire economic system is built. They also form the bridges between spending, income, investment, and borrowing. Simply, without people, there would be no transactions. Further, the productive capacity of the population is the key determinant of the long-term output of goods and services, which are accounted for via transactions.

Income and Spending: Income and spending are two sides of the same coin. The broadest measures of these concepts are GDP and GDI. Mechanically, these two things must be equal, but compositionally, they may differ significantly. These differences are not academic. The compositional differences between GDP and GDI determine corporate profits, household savings rates, government deficit spending, and the international trade balance. All of these changes have vast and varying impacts on macro assets.

Financial Assets & Liabilities: While income and spending account for a large part of economic activity, they do not encompass all economic transactions, as they are largely income statement concepts. As such, they entirely exclude changes that are ongoing on balance sheets. Much like GDP and GDI, the asset and liability side of an economy’s balance are mechanically equal but compositionally different. Changes in the composition of assets (cash, fixed income, equities, etc.) on balance sheets are the driving factors for liquidity conditions.

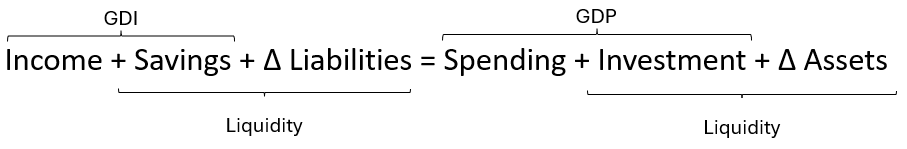

Thus, changes in population dynamics are implicitly captured in economic accounts, while changes in income, spending, savings, investment, assets, and liabilities are captured explicitly. Aggregating these measures, we can intuitively represent economic activity across dimensions using the following identity:

The identity captures virtually all economic activity while allowing us to understand the compositional nuances that drive various asset class returns. We explain further. The mechanical insulation presented above in the form of an identity balances the sources and uses of funds in an economy, offering a comprehensive approach to understanding the economy. On the left side, we have income, savings, and change in liabilities (Δ liabilities). Income encompasses all the money earned from providing goods and services, including wages, profits, rents, and interest. Savings represent the portion of income not used for immediate consumption; funds are set aside for future use or investment. The change in liabilities indicates an increase in borrowing or financial obligations, reflecting additional funds sourced through debt.

On the right side, we have spending, investment, and change in assets (Δ Assets). Spending covers all consumption expenditures by households and firms, capturing the economy's immediate consumption of goods and services. Investment accounts for expenditures on capital goods like machinery and buildings, which boost the economy's productive capacity. Lastly, the change in assets shows the net increase in financial assets, including purchases of securities or increases in cash reserves.

Each of these components corresponds to growth, inflation, and liquidity. GDP and GDI most directly correspond to real growth and inflation. Meanwhile, changes in Assets and Liabilities most directly correspond to changes in liquidity. Finally, savings and investment sit at the intersection between nominal growth and liquidity and form the link between economic activity and balance sheets.

The permutations of these components drive asset markets. For instance, equity markets benefit from elevated nominal incomes, rising corporate savings (profits), increased business re-investment, and financial assets powered by low-risk liabilities. Meanwhile, bond markets benefit from falling nominal incomes, business savings, decreased business investment, and government balance sheet expansion relative to the private sector. Given the increased dimensionality of this approach, the reactions of individual asset markets to this comprehensive macroeconomics are considerably nuanced relative to more traditional approaches. Those nuances are beyond the purview of today’s note. Still, we think the most crucial understanding we can share is that this approach offers a far more precise understanding of macro conditions than tracking a particular silo of macroeconomics.

Overall, we think a rigorous macro approach seeks to develop a holistic understanding of the comprehensive picture outlined here. Our systematic approach is built around a rigorous understanding of this ever-evolving picture. We showcase some of this approach in our Month In Macro note, available only to Prometheus Institutional clients.

You can email info@prometheus-research.com if you would like further details.

Amazing read, Thanks!