The best information we can ever provide investors is the mechanics of how we think about macro conditions over time rather than what we think about them at any particular time.

Consistent with this idea, we present our Macro Mechanics, a series of notes that describe our mechanical understanding of how the economy and markets work. These mechanics form the principles that guide the construction of our systematic investment strategies. We hope sharing these provides a deeper understanding of our approach and ongoing macro conditions.

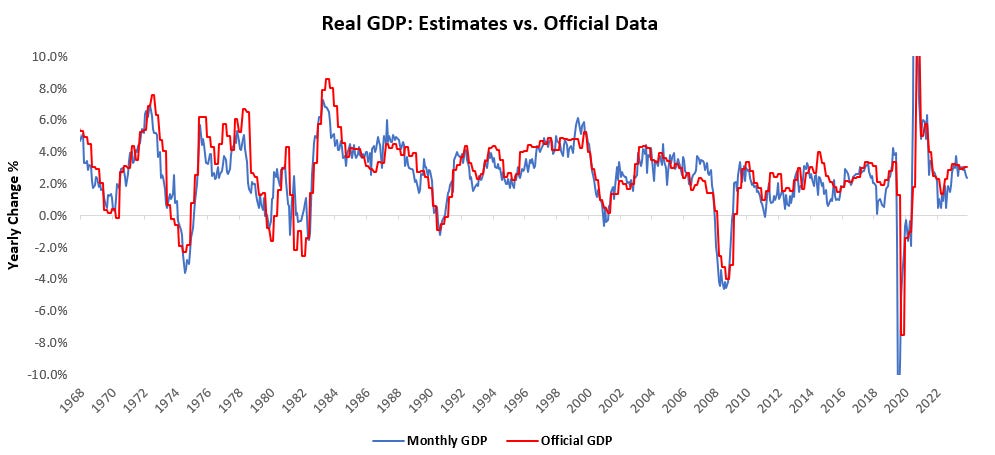

In our last note, we explained the importance of understanding GDP growth to macro investors and detailed its nuanced impacts on asset classes. If you haven’t already, we highly recommend reading through this as it forms a great foundation:

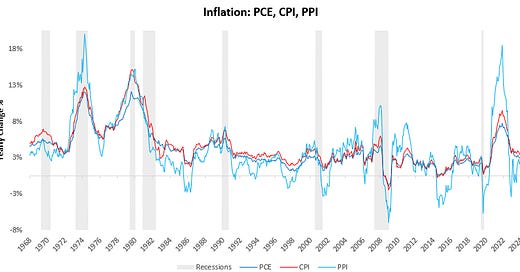

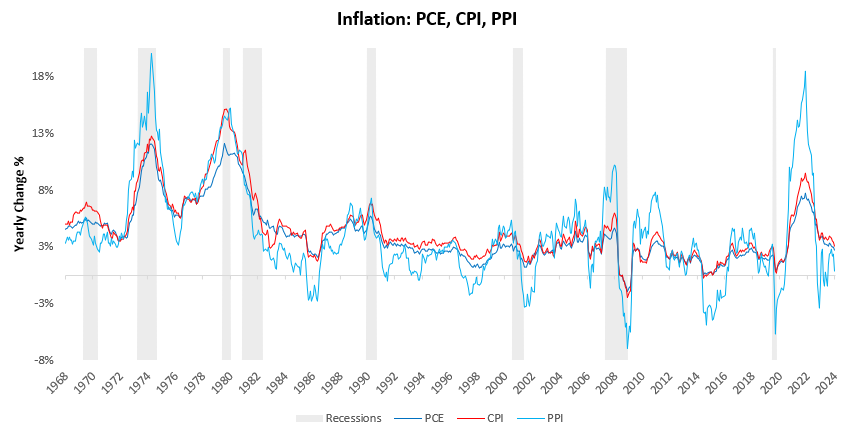

Today, we will offer our thoughts on how inflation works. Before we dive into the implications of inflation, we think it's important to provide a basic understanding of what inflation is. At its core, inflation is a simple concept: the change in the overall price level in the economy. This price level can be measured in various ways: CPI, PCE, PPI, GDP Deflator, etc. Like economic growth, it represents a mechanical framework that has more power than any specific definition.

So, where does inflation come from? We think the most basic, and often overlooked, understanding of inflation is that it is a function of ongoing nominal spending relative to an existing amount of output in an economy. Said differently, inflation is a function of the total nominal dollar demand in the economy relative to the total real supply of goods and services. The most important component of this understanding is that inflation is potentiated by total nominal spending. Over time, nominal spending supersedes output as a driver of inflation; i.e., demand forces largely supersede supply forces in determining inflation. This hierarchy is largely due to the sources of demand and supply.

Nominal spending in the economy can originate from one of three sources: income, borrowing, or the sale of assets. Income in an economy is largely a stable phenomenon, with most income generated by employment. The growth of this employment is limited by the size of the labor force, and while it can fluctuate over the course of a business cycle, it largely moves in tandem with the output created by workers. As such, spending powered by income can be stable but has natural limitations on its impact on nominal spending. Unlike income, borrowing has no physical limitation but is constrained by the expectations of borrowers and lenders. Importantly, unlike income growth, borrowing does not have as tight a link to output and can expand far more quickly than output, creating a significant amount of excess nominal spending relative to output. Finally, the sale of assets—such as selling cash, stocks, bonds, or real estate to finance spending—can also drive nominal spending that potentiates inflation. However, large-scale asset sales are usually indicative of a shortfall in economic activity and are typically used to essentially plug a hole in spending by economic actors rather than as a durable source of ongoing spending. Economic agents are net buyers of assets over time, and sustained selling of assets is only likely in cases of financial contagion.

Summarizing the nature of the sources of nominal spending: income grows in a manner largely consistent with output, borrowing can experience significant volatility over the business cycle in excess of output, and asset sales are an unsustainable source of ongoing spending. As such, borrowing tends to be the key determinant in whether nominal spending accelerates much faster than the ongoing pace of output, i.e., inflation. The converse is often true as well; the pullback in borrowing often drives the reduction in prices, i.e., deflation.

Now, this distribution of nominal demand is an archetype, and specific instances can vary quite dramatically. For instance, the post-COVID-19 cycle saw the sale of assets (government cash stimulus) as the primary driver of excess spending relative to output. However, over time, we expect most nominal spending-induced inflation to come from borrowing cycles due to the mechanical constraints on income and asset sales.

While we have thus far focused on nominal spending, this is not to say that output is not an essential part of the equation. It is simply the recognition that output has physical constraints related to the factors of production that nominal spending does not adhere to to the same extent. We elucidate by diving into the drivers of output. In the broadest sense, there are only two types of output: goods and services. Goods refer to all physical production, ranging from raw commodities to complex products like mobile phones and everything in between. The production of these goods is largely limited by the existing production capacity of the economy, which takes a significant amount of time to build. Thus, while goods production can rise to match nominal spending, there are physical resource limitations on how much goods production can increase. On the services side, we see a similar limitation. Most services are generated through the use of labor: doctors, lawyers, retail workers, etc., exist in a finite amount. As such, the size of the labor force largely limits how much we can expand services production relative to the ongoing pace of nominal demand. The notable exception to these limitations are digital, zero-marginal cost products, which have no extra cost of production. However, these zero-marginal cost items are a relatively small portion of total expenditures and therefore tend to have a limited impact on inflation dynamics. These physical limitations set a ceiling and floor on the degree to which output can expand or contract, making it less volatile than nominal spending. Now, once again, this is an archetype that is true over time, but not all the time. Output can go through supply shocks, where the supply of goods or services abruptly moves upwards or downwards, often due to idiosyncratic events like natural disasters or wars. These supply shocks can cause significant recalibrations to the balance between nominal spending and output, which can lead to significant inflationary or deflationary forces. Nonetheless, these shocks occur less frequently and explain less of the variance of inflation over time.

Taking stock of the sources of nominal spending and output, borrowing makes nominal spending far more volatile than output. Therefore, in an expanding economy, nominal spending determines inflation far more often than output. The intersection between nominal spending and output is most volatile in the goods economy, where nominal spending is dominated by borrowing, and output is tightly constrained by production capacity. Given this dynamic, most significant inflationary dynamics emanate from the goods sector and slowly make their way up the supply chain towards the services sector. This confluence of dynamics is what makes goods inflation "lead" services inflation over time. This leading nature of the goods sector is not a given, just a function of the sensitivity to borrowing and its relative position in supply chains.

Now that we have explained and outlined our understanding of where inflation comes from, we turn to how it is reflected in markets.

Inflation and commodities are synonymous. Commodity prices are a subcomponent of the inflationary dynamics we have described in this note. When the goods economy experiences changes in nominal spending, these changes are reflected in commodity prices. These prices also form the basis of all input costs across the economy, and persistent increases in commodity prices drive broader inflation. Therefore, liquid, traded commodity prices are both a reflection of the ongoing inflationary dynamic and a driver of prospective inflationary forces further up the supply chain. Generating an edge on commodities requires an in-depth assessment of inflationary forces, i.e., nominal spending and output.

Equities have a mixed relationship with inflation. Inflation is not equally distributed across the economy. Businesses and consumers experience different levels of inflation. Businesses often capture prices further down the supply chain, while consumers consume products further up. This creates a dynamic where businesses can benefit from rising prices, but this largely depends on whether their revenues are inflating at a faster rate than their costs. As such, aggregate inflation is neutral for equities, as they benefit from rising nominal revenues but are hurt by rising costs.

Bonds suffer from high inflation. As we have described in our previous mechanics' notes, bonds are fixed-income assets that look less attractive as variable cash flows in the economy begin to rise. Furthermore, the bond market is dominated by the actions of the Federal Reserve, which moves to curtail inflation through its interest rate policy. The hiking of interest rates mechanically increases bond yields and hurts bond prices. Additionally, bonds can be affected by inflation by the impact of their "term structure," which is a topic for another date.

Overall, inflation is a function of nominal spending relative to output. Nominal spending has higher volatility than output over time due to leverage, making it the primary driver of inflation over time. Inflation typically makes its way up the supply chain, during which time it benefits commodities, is largely neutral for equities, and hurts bonds.

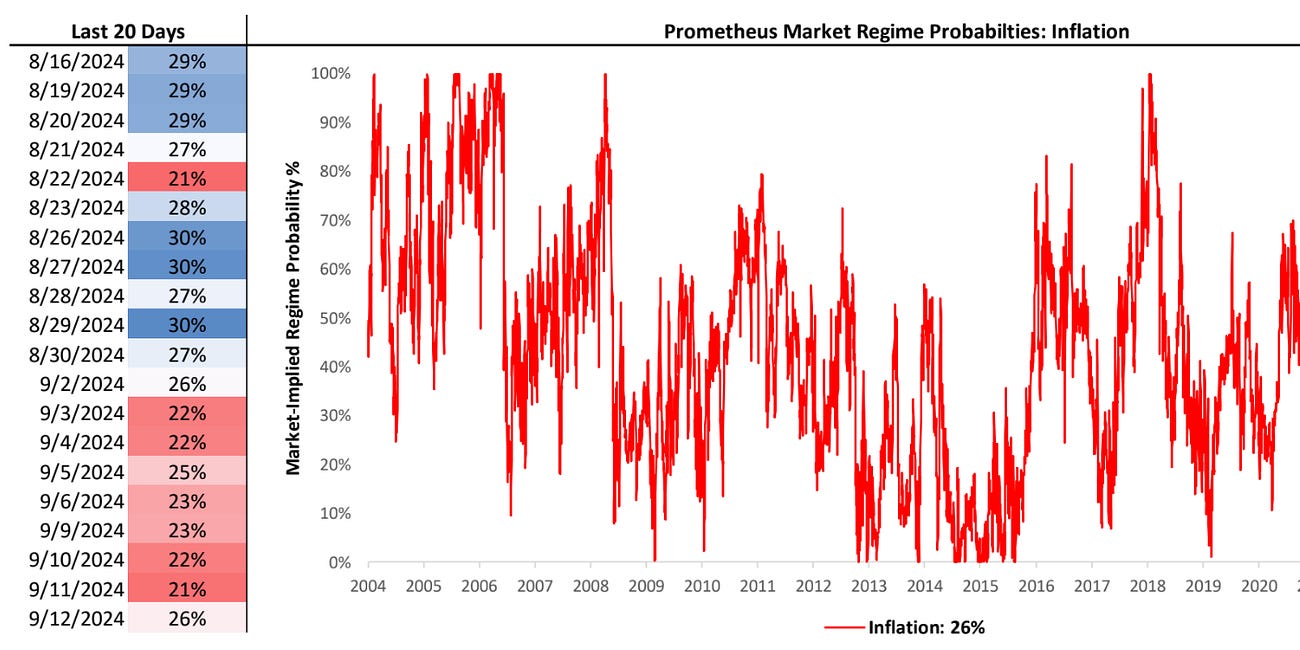

We hope this helps shed light on our mechanical understanding of inflation dynamics. Consistent with these principles, we have built our systematic process around a rigorous understanding of these inflation dynamics.

If you would like to see how we apply these mechanics to macro & markets, you can look at our most recent note on inflation.

Great post, as always. Question: What indicators/metrics do you look for to see if the goods economy is experiencing changes in nominal spending? I've looked at several data sources in FRED, but most are very delayed. any suggestions? thanks