This note is one typically reserved for clients of Prometheus Institutional. Occasionally, we share notes from our Prometheus Institutional to augment our retail offering here on Substack. If you are interested in access to our institutional work, you can click this link:

Or email us at info@prometheus-research.com.

Commodities have come into the spotlight once again, now the best-performing macro asset in 2025. Spiking commodity prices tend to translate into rising inflationary pressures in markets and the significant underperformance of bonds. Given global geopolitical dynamics and ongoing tariff tensions, many now expect inflationary pressures to ensue, powering commodities into a durable bull market. In today’s note, we evaluate the potential for a sustained bull market in commodities, leveraging our systematic process. If you’re unfamiliar with our approach to commodity markets, we highly recommend reading our Macro Mechanics note, which outlines our framework.

Let's dive into today's note. Our assessment is as follows:

The latest data has shown a broad-based rise in industrial production from contractionary levels.

While this increased output supports business revenues, manufacturing wages continue to exceed these revenues, creating a profit squeeze.

Relative to these fundamental developments, commodities have begun to rally significantly relative to stocks and bonds, creating a strong cross-asset trend. As such, macro market trends are now at odds with the underlying fundamental pressures.

Systematically quantifying this picture allows us to understand whether commodity markets can continue to rally. Today, commodity markets may offer intermittently positive returns but cannot enter a prolonged bull market without significant improvements in the economy.

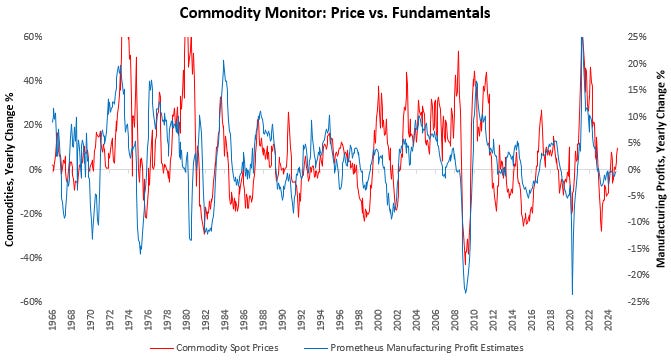

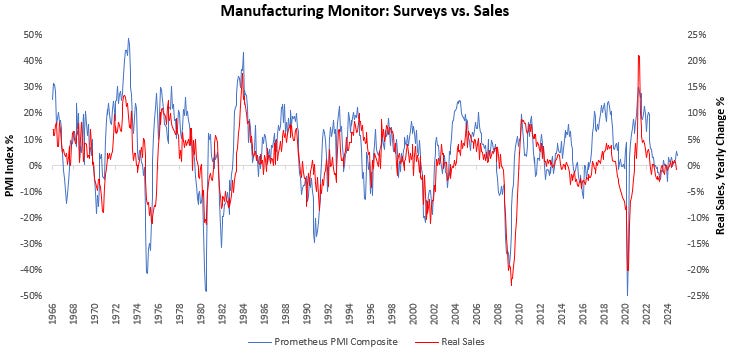

The primary demand for commodities in the economy comes from the manufacturing sector, which uses commodities as inputs for an extremely wide array of products. The financial health of these sectors determines their ability to lever up their business and, in turn, determines the principal driver of commodity demand over time. We visualize this relationship below:

Above, we show that manufacturing profits are a strong barometer of commodity price changes. Given this relationship, we carefully monitor ongoing developments across the entire manufacturing complex to assess the potential for future commodity market prices.

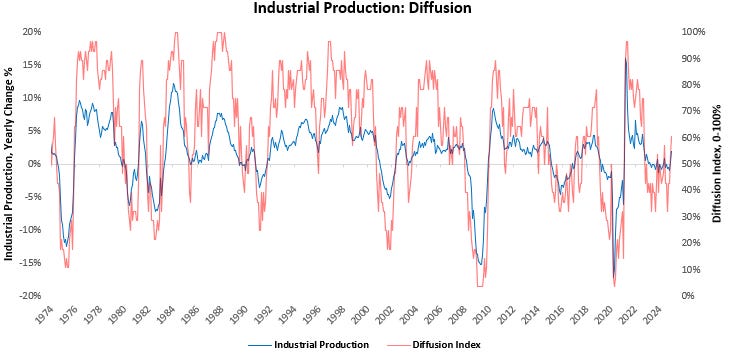

As we noted in our summary, the most recent data has shown an uptick in broad-based production conditions. We visualize this improvement below:

Above, we show the current annual growth in industrial production and the underlying breadth of this construction. According to the latest data, both growth and diffusion have improved.

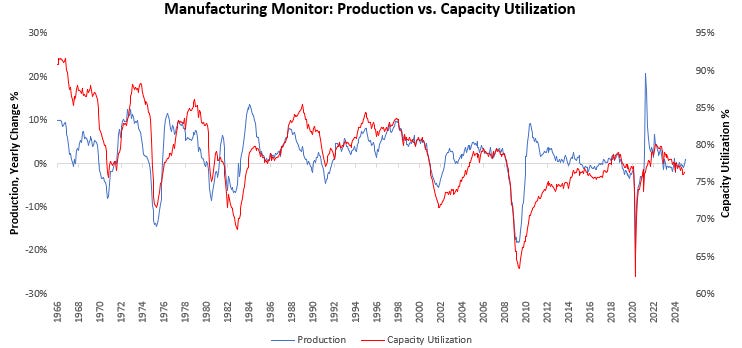

While this high-level industrial output number has indeed risen, we find that manufacturing-specific production has been less responsive. Furthermore, we continue to see manufacturing production capacity utilization remain muted.

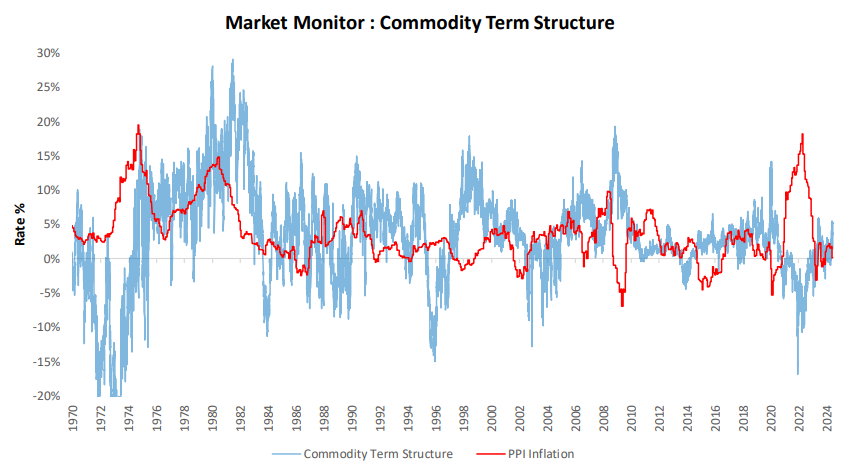

The commodity market reflects the tightness of supply relative to demand, which is well captured by capacity utilization. Capacity utilization remains muted despite a modest increase in production, suggesting that demand is not significantly exceeding supply capacity. Thus, while total industrial production has improved recently, manufacturing demand remains relatively cool.

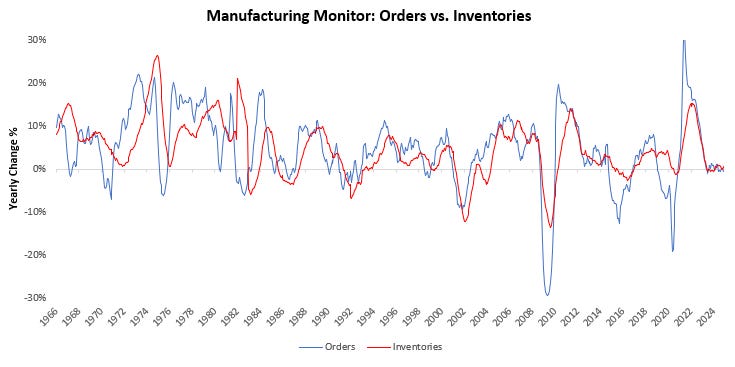

In addition to output and capacity utilization, which allow us to gauge the current strength of top-line conditions, we can also turn to manufacturing new orders and inventories to understand forward-looking pressures for the sector.

The gap between manufacturing orders and inventories is filled by new production. Today, new orders for manufacturing remain low, and inventory growth remains flat. The combination of these drivers suggests flat-forward-looking out and sales.

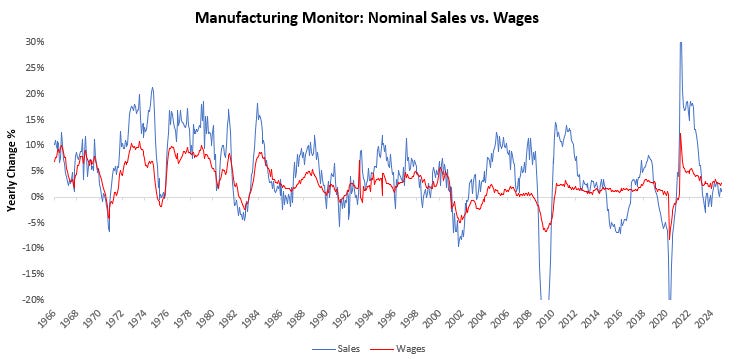

While these forward-looking measures suggest weaker future revenues, even current revenues are unsupportive of profitability. Like any business, profits are a function of the sales generated relative to the costs incurred. At the macro level, the primary driver of these costs tends to be labor costs in the form of wages. Below, we visualize the contribution and a dilution of manufacturing profits coming from revenues and wages, respectively:

Above, we show how, despite a modest increase in nominal manufacturing sales, the wages paid by manufacturing firms continue to absorb all these sales, creating a negative profit backdrop.

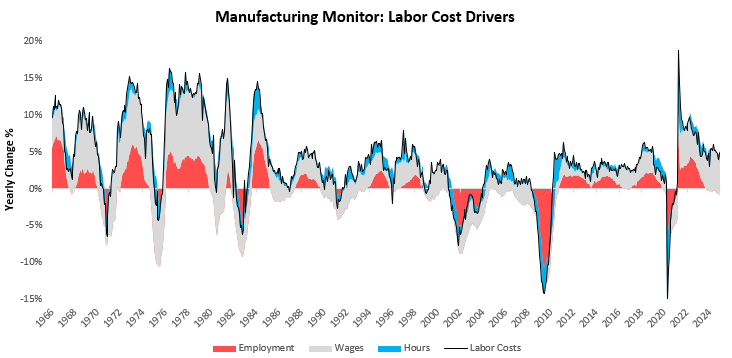

This elevated level of wages is not because of increasing employment but due to an elevated level of nominal wage growth. We visualize the composition of wage growth below:

As we can see above, the resilience of nominal labor costs is primarily driven by resilient wage inflation. This resilience exists despite material and consistent layoffs in the sector:

As we see above, layoffs in the manufacturing sector have been pervasive.

Looking further ahead, there are two potential ways we can see a positive profit environment restored in this sector. The flayoffs continued layoffs in the sector, which will have continued negative ramifications for the sector, the broader economy, and commodity markets. We see this as the most likely path.

Alternatively, if the reduced pressure through layoffs leads to an increase in future expectations, we may see further leveraging up of the sector. We see some indications of these positive expectations in PMI data:

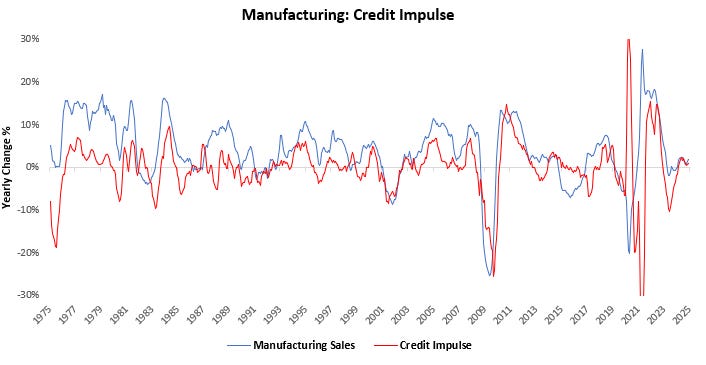

These modestly higher PMIs are reflected in modestly accelerating borrowing for the industrial sector. We visualize this below:

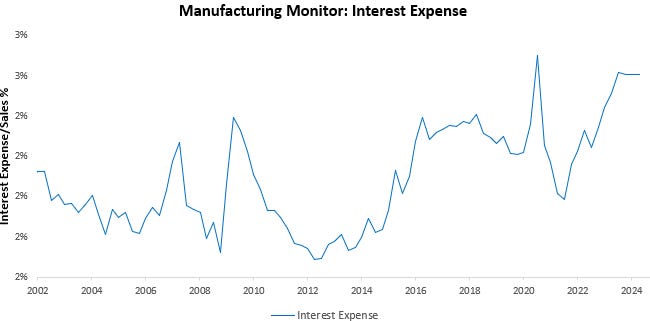

As we can see above, the credit impulse for manufacturing has improved modestly, exiting contraction. However, a sustained increase in manufacturing borrowing remains limited by elevated and rising debt service burdens for the sector. We visualize this below:

Thus, of the two avenues that we see as possible to restore positivity to manufacturing profits, we expect the sector to lean on layoffs more so than leverage. This will likely mean that activity in the sector will continue to remain soft, which will be a modest weight on the broader economy.

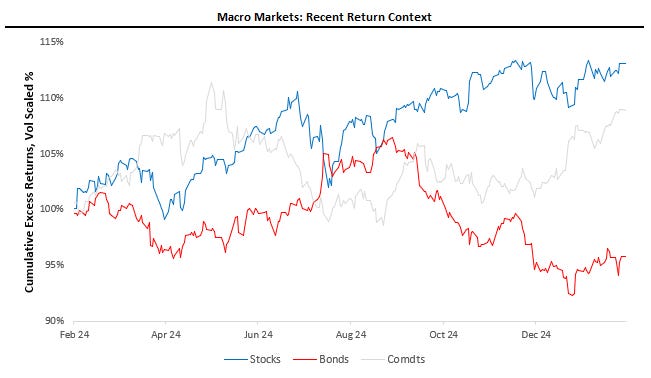

Relative to these fundamental dynamics, commodity markets have now begun to rally significantly relative to stocks and bonds:

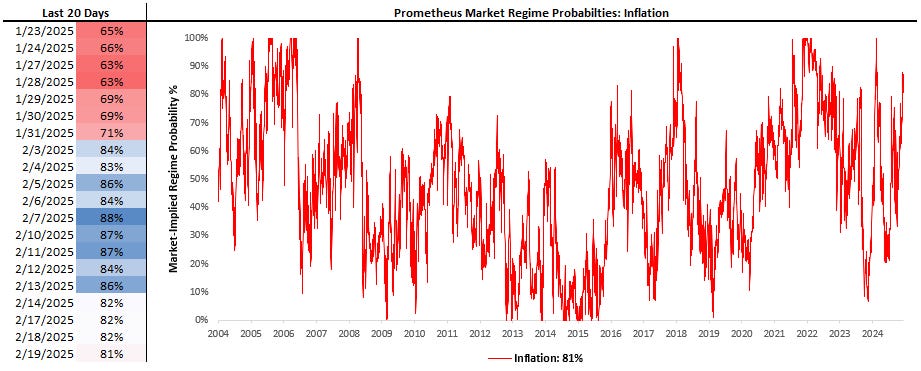

On a volatility-matched basis, stocks have risen by 1%, bonds have fallen by -4%, and commodities have risen by 8% over the last quarter. The combination of these price movements has created an elevated probability of macro markets pricing in a rising inflation environment. We visualize these probabilities below:

Thus, we have a fundamental backdrop that does not look supportive for commodities but a market backdrop that is extremely supportive.

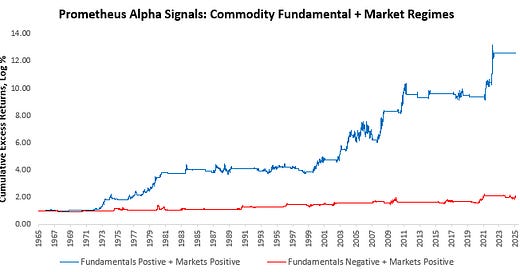

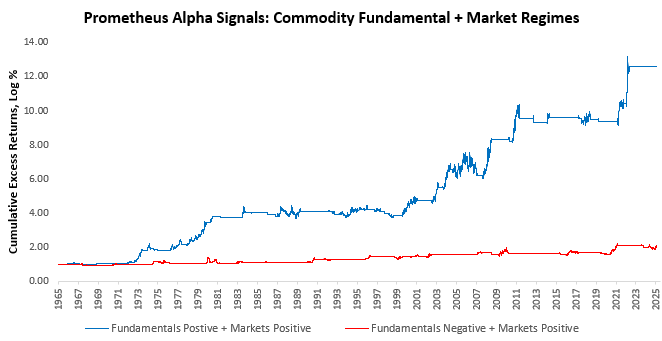

To better understand what kind of expectations we can have for commodity markets during such a mixed backdrop, we can leverage our use our programmatic understanding of economic conditions to create two backdrops: one where both fundamentals & markets indicate strong expected returns for commodities and the second when markets are indicating strong conditions, while the economy indicates weak conditions.

Based on this regime recognition, we can create two portfolios. The first buys commodities when the fundamentals and markets are positive. The second buys commodities when fundamentals are negative and markets are positive. We visualize these portfolios below:

As visualized above, commodity markets require both fundamental and market conditions to be conducive to commodities for persistent bull markets. Buying commodities when fundamentals and markets are positive results in a Sharpe Ratio of 0.56. Meanwhile, buying commodities when fundamentals are negative while markets are positive results in a Sharpe Ratio of 0.21. Today, while macro markets in aggregate look fairly consistent with a bull market in commodities, fundamental conditions are likely to hold back returns. This lack of fundamental support does not mean commodity markets cannot experience bursts of positivity as they have over the last few months; it is just unlikely to be a persistent rally unless conditions in the manufacturing sector improve.

If you want to use an investment process that leverages all this information, we recommend checking it out:

If not, thanks for reading. Until next time.