Welcome to Prometheus ETF Portfolio. The Prometheus ETF Portfolio aims to allow everyday investors to access an investment solution that combines active macro alpha, passive beta, and strict risk control, all in an easy-to-follow, low-turnover solution. We aim to achieve strong risk-adjusted returns relative to cash, with limited capital drawdowns in depth and duration. We do this in a highly accessible package, which rotates between three highly liquid ETFs, readily available to any investor with a brokerage account.

Let’s dive into our observations.

Market Monitor: Over the last week, macro markets rose in aggregate, with stocks rising, commodities rising, treasuries rising, and gold rising. Markets have moved to incrementally price a rising liquidity environment. More broadly, our market regime monitors are showing a dominant market regime probability of falling growth, rising inflation, and rising liquidity.

Economic Data Monitor: Economic data momentum remained flat over the last week, with mixed industrial production, retail sales, and jobless claims data. Over the last week, Retail Sales: Less Autos was the data release that macro markets took the most signal from, with stocks rising, bonds rising, and commodities falling.

Asset Class Signals: Signal remains consistent in terms of its regime implications, i.e., markets are likely to price in rising nominal growth. Under the surface, we are seeing a modest redistribution from nominal growth to real growth.

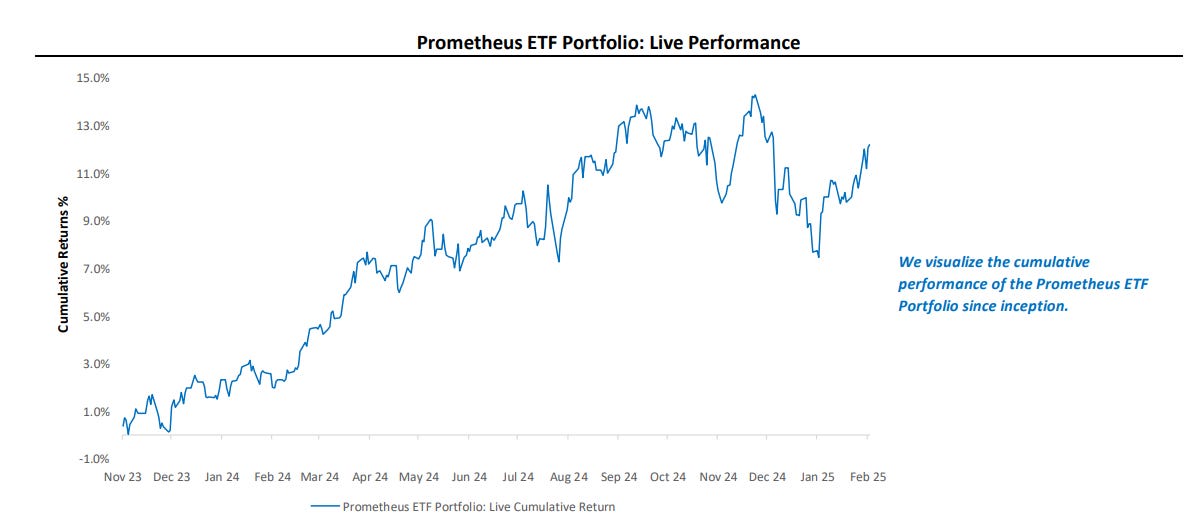

ETF Portfolio Updates: Over the last week, the Prometheus ETF Portfolio was up by 1.66%. The contributions to these portfolio returns were as follows: 0.8% from stocks, 0.86% from commodities, 0% from bonds, and 0% from cash.