Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

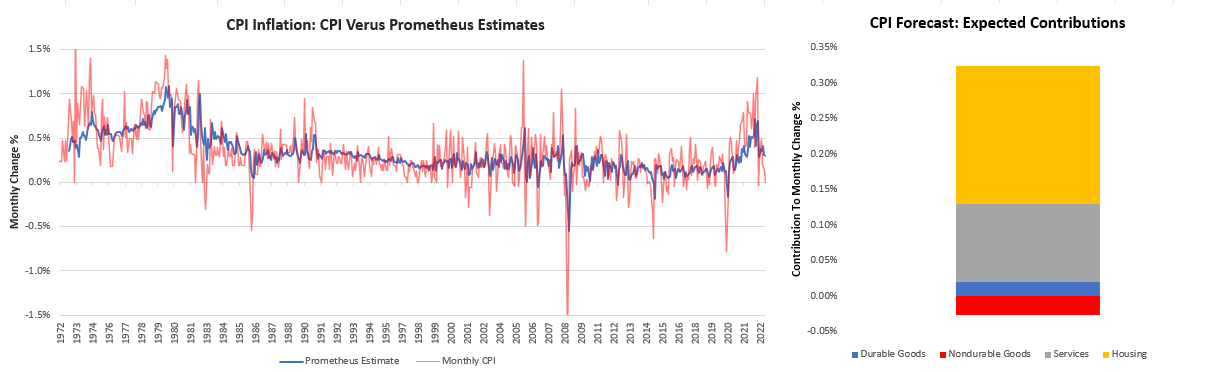

We’ll keep this note brief. Headed into tomorrow’s CPI, our systems expect CPI to come lower than the consensus expectation. Our systems estimate that CPI will increase 0.38% versus the prior month, while consensus expects a 0.5% increase. This estimate is consistent with a 4.6% inflation rate. We think there are significant odds of consensus being surprised to the downside. We show our expected attribution below:

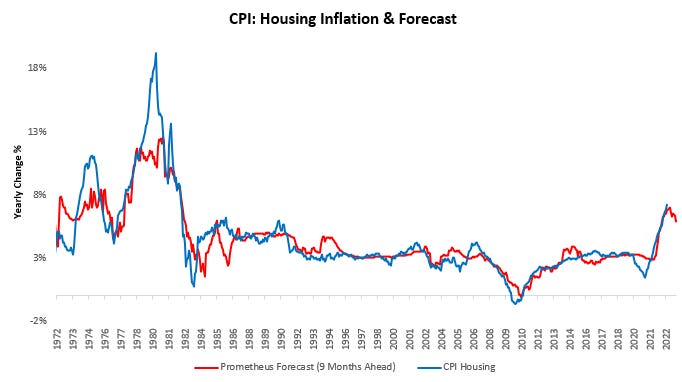

Driving our estimates, a combination of a slowdown in housing prices and a weakening of the goods economy. Below, we show our estimates of the cyclical pressures in place on housing CPI coming from home prices:

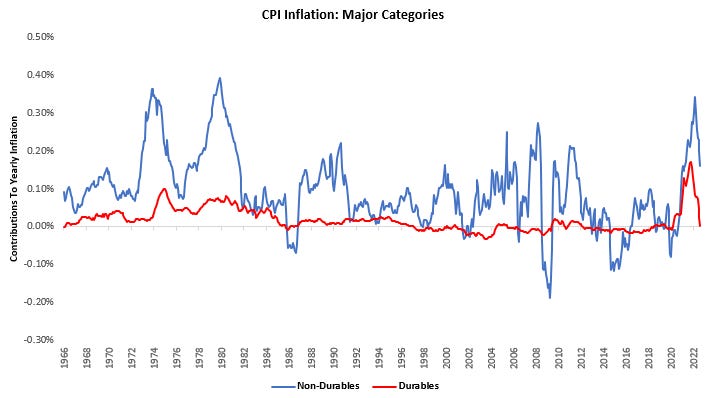

Our latest estimates place housing at approximately 0.6% versus the prior month. Furthermore, we expect the deterioration in the goods economy to continue to push price activity lower. We show the existing drag from durable and non-durable goods below:

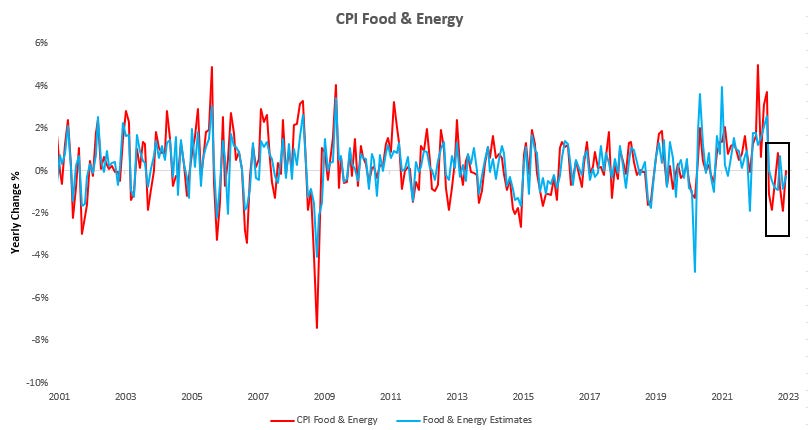

In particular, we expect this print to be meaningfully impacted by the non-durables segments of the economy, which have been meaningful supports to the overall inflation picture. Below, we show our estimates for food & energy inflation, which we expect to have a deflationary impact:

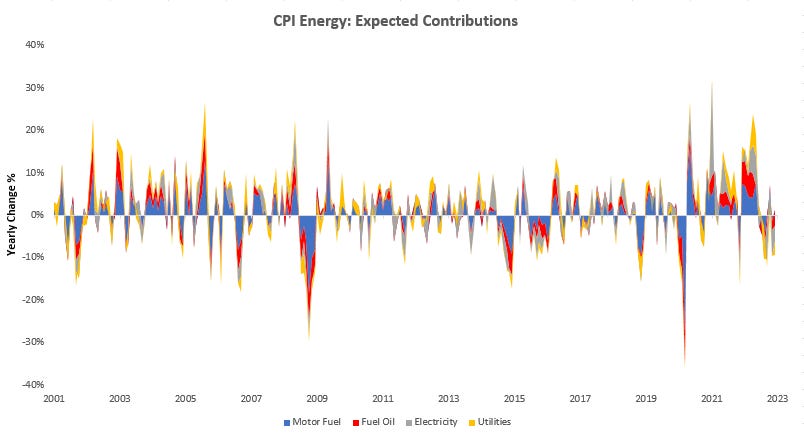

In particular, our tracking has shown weakness within the energy complex, though the picture is somewhat mixed under the surface. While the largest component of energy, i.e., motor fuel, has shown some strength and is likely to be additive to inflation, we see utilities, electricity, and fuel oils all dragging on the aggregate energy contribution. We show this below:

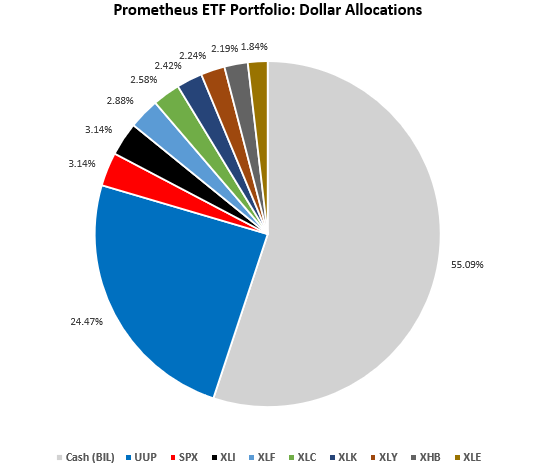

We think this also plays a large role in our divergence from consensus expectations for his print— consensus largely focuses on the relationship between motor fuel and energy. However, we should note that the size of the shock we see in energy isn’t exceedingly large, which makes the potential for the impact of technical factors in the inflation calculation to diverge from our estimates. Nonetheless, we think both our cyclical assessment and monthly estimates both support a potential inflation disappointment. Thus, headed into this print, we think active investors would be best positioned by maintaining our existing equity long positions and sizing down the dollar:

On the same coin, this strategy would require active management, with the potential for large moves to the downside significant in the event of an upside surprise. A CPI print in-line with our expectations will confirm our expectations of an ongoing slowdown; a print significantly above would suggest we need to adjust our outlook incrementally. The data will tell. Until next time.

Looking at the tree, missing the forest !

Glad I’m not the only one expecting a cooler CPI print