Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

Recently, much attention has been paid to liquidity conditions and how their amelioration has spurred increased market activity. In this note, we share our tracking of these conditions.

Before we dive into our tracking, we think it necessary to outline our thoughts on liquidity. Liquidity is the flow of cash and cash-like assets in the economy that potentiate future economic activity. This flow can be created by either the private or public sectors through the creation of financial assets and their corresponding liabilities. Liquidity is a store hold of economic value, with minimal risk of nominal dollar loss. All financial assets exist somewhere on the liquidity spectrum; however, they differ in terms of where they rank in the liquidity hierarchy. This ranking is primarily driven by the risk of the borrower issuing the financial liability. Therefore, the government sits atop the liquidity totem pole, followed by financial institutions, corporates, and households. Given that all liquidity is essentially a liability, two dimensions impact liquidity— issuance (quantity) and interest rates (quality). Higher issuance & lower interest rates increase liquidity, and lower issuance and higher interest rates impair liquidity. Liquidity potentiates future activity in both the real economy and financial markets, and thus as liquidity expands or contracts, the potential for nominal activity expands and contracts. This function is particularly important to policymakers, as liquidity can be used to achieve societal objectives— i.e., speed or temper the economy.

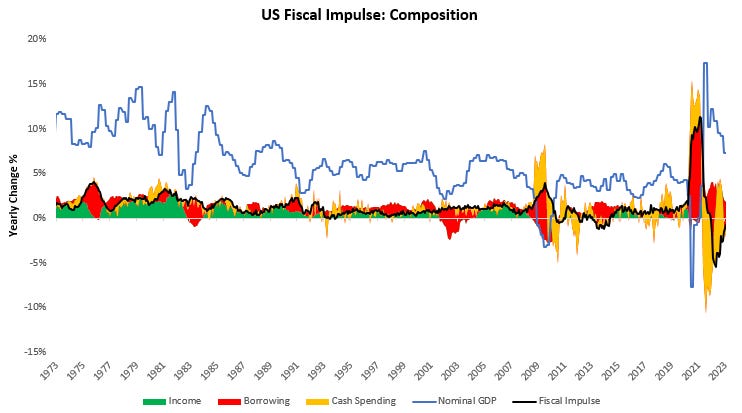

The Federal Reserve controls interest rates across the economy by setting policy rates, with all other interest rates pricing risk relative to policy rates, while the Treasury control issuance of Federal securities. We call the combination of these entities the US Sovereign, whose liabilities are the assets of the private sector. The US Sovereign is the issuer of the currency, and thus its ability to meet interest payments is rarely in question, making its liabilities the highest quality liquid asset for any given duration. The purpose of government borrowing is to offer a store hold of wealth while redistributing excess private income in the economy to achieve some measure of societal good. This spending from borrowing, alongside spending from income, creates the fiscal impulse, which is additive to GDP. Below, we show the fiscal impulse and its contributions to GDP:

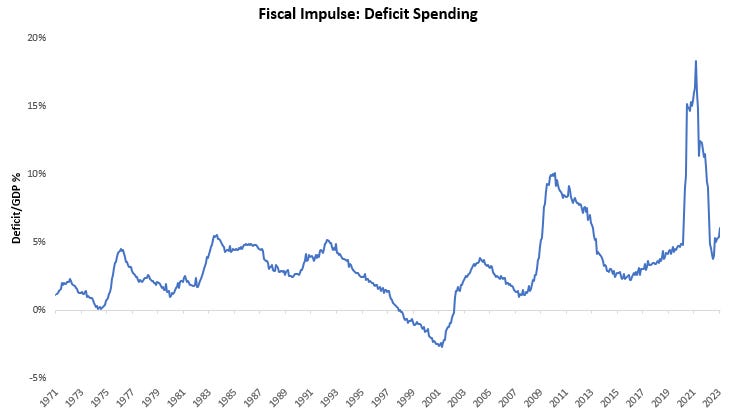

The first-order impact of policy liquidity creation is that it uses savings to create spending, which generates income. Additionally, the private sector absorbs a high-quality asset, which also generates interest. These two impacts are simply a function of issuance, income, and spending. In today’s setting, the fiscal impulse has improved marginally, though it remains a drag on economic activity. This translates into a modest uptick in government deficit spending:

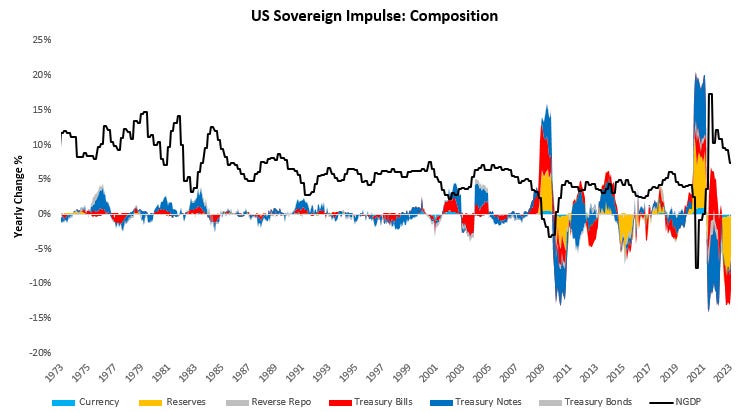

Alongside the impact of gross issuance, the composition of issuance becomes important to financial markets; the more short-dated the issuance, the less chance there is for private capital sector losses— i.e., the more short-date the issuance, the more liquidity inducing the gross issuance becomes. The Federal Reserve can significantly impact this composition of the US Sovereign liabilities through quantitative easing and tightening (QE & QT) programs. When the Federal Reserve engages in QE or QT, it embarks on maturity transformation, i.e., it changes the composition of the US Sovereign, making it more or less liquid as it purchases Treasury securities and gives the financial systems liquid reserve assets. Below, we net out these impacts to show the aggregate policy impulse from the US Sovereign:

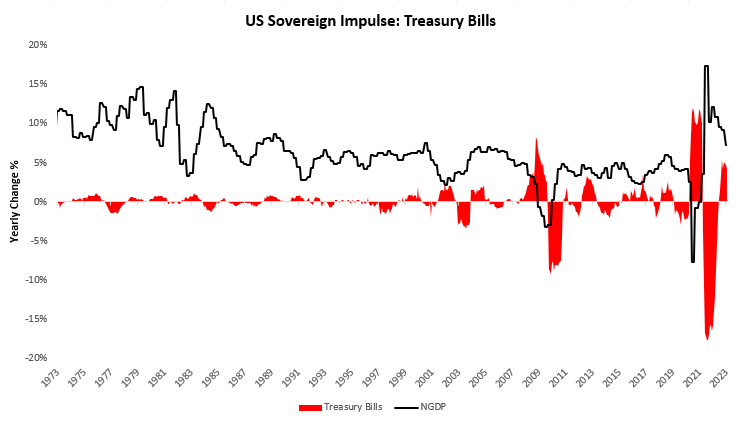

As we can see above, the policy impulse has dragged activity and liquidity conditions. However, we have seen significant moderation after dramatic declines in 20220. Of particular note over the last few months has been the outright acceleration in bill issuance, which we show below:

Putting these factors together, the US policy impulse has marginally improved over the last quarter. January, in particular, was strong for policy liquidity, with US Sovereign liabilities increasing by $216 billion, with $246 billion of Treasury bill issuance. Much of this Treasury bill issuance was simply cash moving from the Fed’s Reverse Repo Facility (RRP) into Treasury bills, with RRP declining by $212 billion. Overall, the policy liquidity picture slowed its dramatic decline, with large Treasury bill issuance helping sequentially improve liquidity conditions.

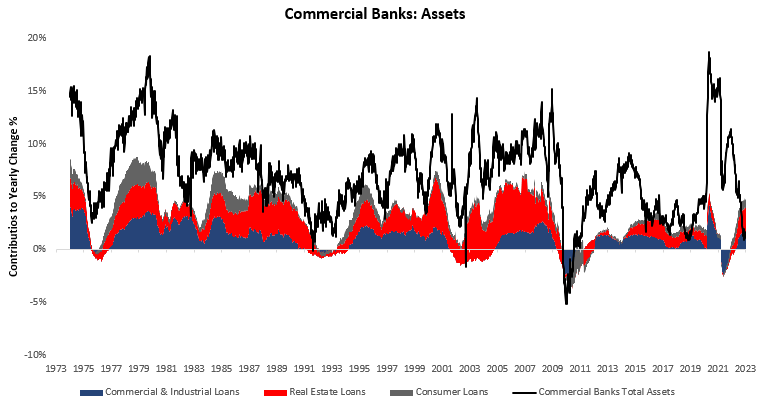

Alongside this amelioration in the declines in the policy impulse, we have seen significant liquidity creation by private sector entities over the recent past. Mainly, we have seen commercial bank increasing their credit exposure to the real economy. Particularly, banks have procyclically increased their exposure to commercial loans, real estate loans, and consumer credit. We show this below:

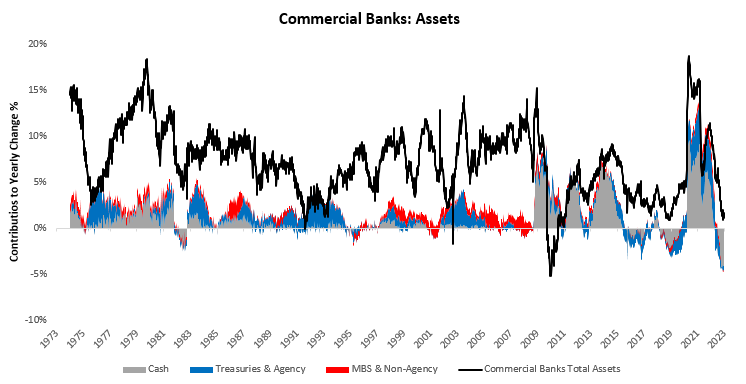

However, these impacts were offset by declines in both reserve balances/cash (through QT) and Treasury, Agency, and MBS reductions:

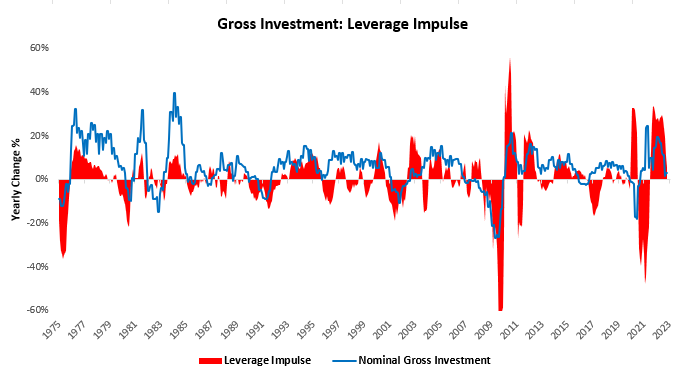

The combination of these factors is a drag on aggregate deposits within the banking system; however, they are not indicative of a tightening of procyclical lending and borrowing. In fact, our estimates show that the leverage impulse from private-sector borrowing remains net support for gross investment, even though gross investment continues to weaken:

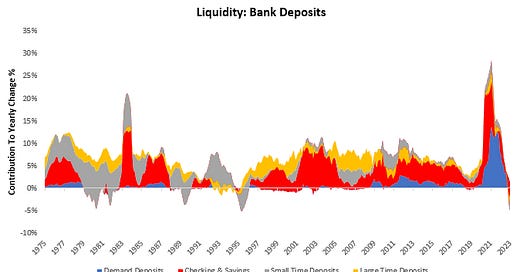

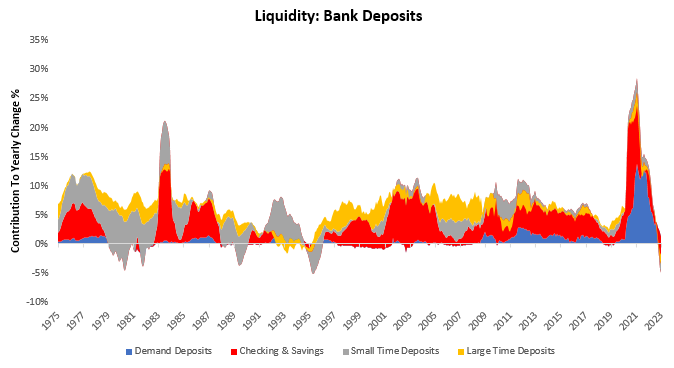

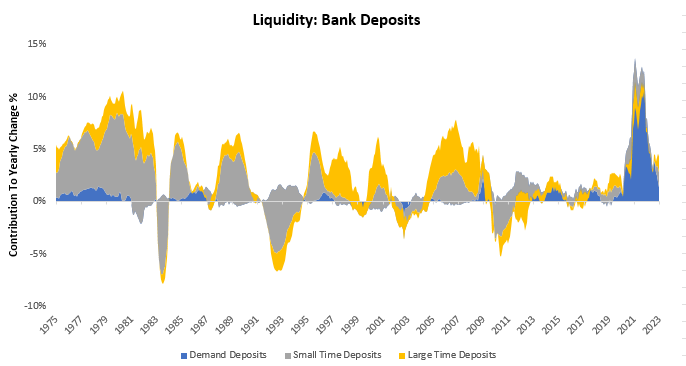

Therefore, while monetary aggregates have contracted, they have largely come as a function of the pullback in monetary and fiscal stimulus rather than the weakening of private sector lending. This tightening policy liquidity has contributed to a contraction in bank deposits, primarily in the form of declining checking and savings account balances. We show this below:

As we can see above, checking and savings account for all of the contraction in deposits, with long-maturity deposits actually expanding significantly. We zoom in on this below:

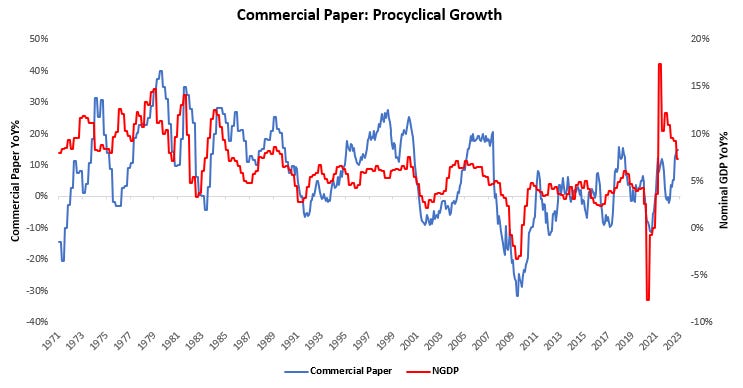

We see further evidence of this strength in procyclical liquidity in corporate borrowing markets. Much like the financial sector and government, the corporate sector is also a liquidity creator, though they rank lower on the hierarchy. Much like bank credit, we have seen corporate credit issuance expand. Particularly, we have seen an expansion in commercial paper activity, which is in line with the elevated levels of nominal business activity we saw last year. Below, we show the growth of commercial paper, along with nominal GDP, to emphasize the procyclical nature of commercial paper issuance:

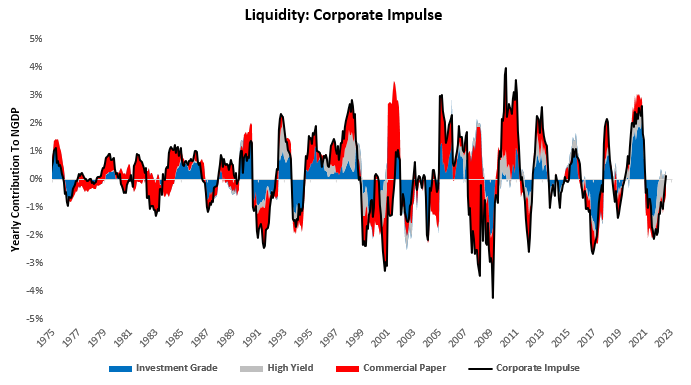

This increase in commercial paper issuance came alongside an increase in investment-grade issuance but an offsetting decrease in high-yield issuance. Below, we show the corporate impulse arising from these forces:

Overall, much like policy liquidity, the most liquid issuance in corporate markets saw improvements over the last few months. The combination of these factors speaks to an environment where nominal lending activity was still supportive of nominal spending (albeit at a slowing clip), which came from the issuance of highly liquid liabilities.

Adding up these moving parts, we see a situation where composition factors have moved policy liquidity marginally up, and a strong nominal economy has facilitated increased lending and credit. Furthermore, the impacts of policy tightening on discounting of cash-flows is largely behind us. The combination of these factors has created a temporary bottoming in liquidity conditions. However, our expectation for economic activity leads us to think that it is highly unlikely for private sector liquidity to continue at its current rate of expansion. As economic activity moderates and profit compression continues, borrowing and investment activity will likely weaken. Alongside this, we expect Treasury bill issuance to remain modest, along with muted issuance relative to recent quarters. Summing up, the fastest part of liquidity contracting, which came from rising interest rates and a contracting sovereign balance sheet, is likely behind us. However, ahead of us remains an ongoing reduction in policy liquidity, along with potentially weak procyclical liquidity. The picture may be marginally better, but it’s not a good one.

Much better alternative to whats on twitter recently

What about large liquidity increases from BOJ and PBOC, which according to Michael Howell and some others ofset FED's actions. He also claims, that even FED for the past few monts (past UK debt problems) is tiqtening predominately verbally but in fact not much.