Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

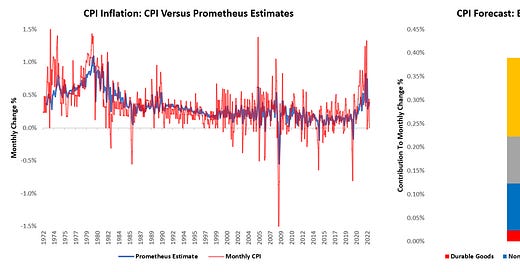

We’ll keep this note brief— our systems expect an upside surprise to CPI expectations tomorrow. Our systems estimate that CPI will increase 0.39% versus the prior month, while consensus expects a 0.3% increase. The primary driver of our estimate is housing inflation, which our systems expect to be the largest contributor to the print. Relative to consensus, we expect that goods inflation will likely be a contributor to inflation rather than a detractor, as predicted by consensus. Below, we show our expected contributions to the print:

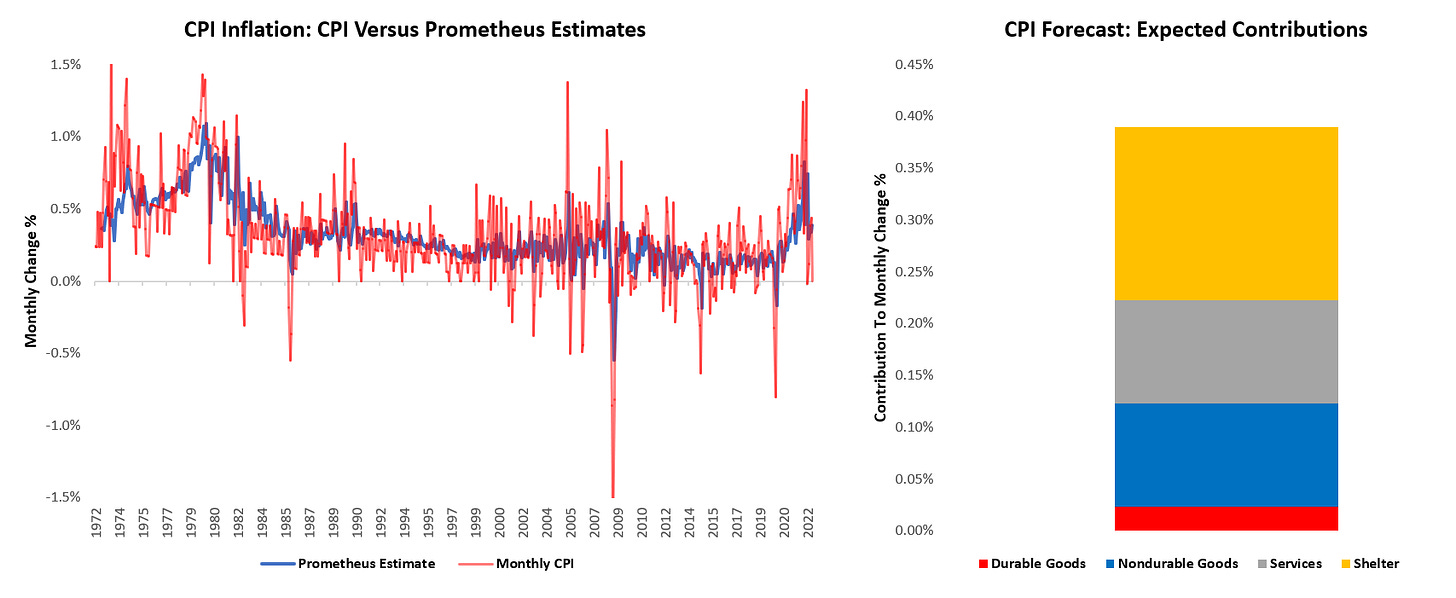

The divergences between goods and services inflation remain in place, with goods largely accounting as a swing factor on a print-by-print basis, while shelter forms a stable undercurrent for inflationary pressures. Below, we show the relative divergence between goods and services, along with our projection for housing inflation:

We expect the highest housing inflation is likely ahead of us; however, durable goods deflation is already upon us. In this print, we will look for further information regarding the balance between these two trends. Heading into this print, our systems expect durable goods inflation to remain subdued. However, nondurable goods inflation has the potential to stay positive, especially relative to consensus expectations. We saw the reinforcement of these expectations coming from PPI data on Friday. While energy prices were lower in PPI, food and consumer nondurables adequately offset these declines. We show this below. Additionally, producers are often able to pass on commodity price increases to consumers contemporaneously, which could potentially support nondurable consumer inflation:

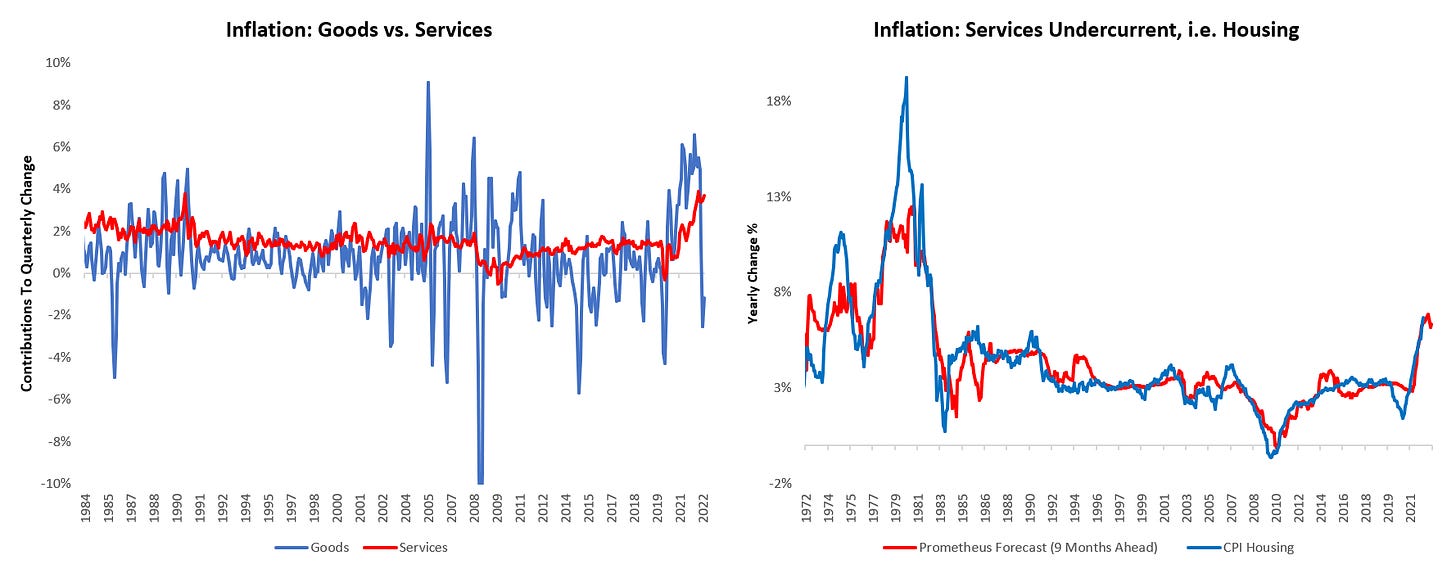

Our systems have generally been a good guide on the CPI prints. We show the fit of expected CPI versus realized CPI below:

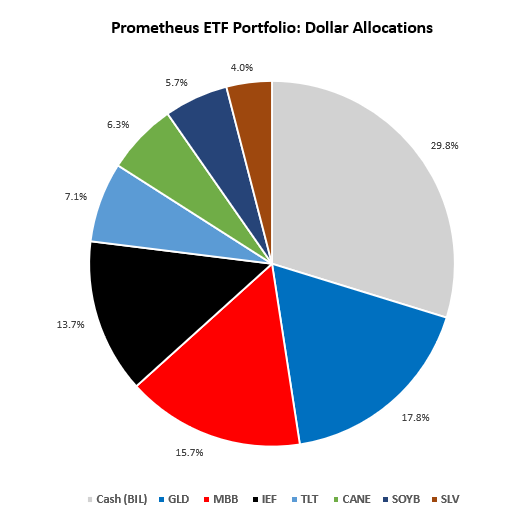

Therefore we think it is worth assessing the risks to our positioning— particularly for those using the Prometheus ETF Portfolio as a guide. To reiterate the positioning of our systematic ETF portfolio, as explained in our note on Friday:

The primary risk to this portfolio heading into both CPI and an FOMC meeting is its exposure to fixed income. The size of the expected surprise in CPI is benign relative to recent history, and the potential mispricing is not significant. However, the potential market & Fed reaction functions will likely dominate, creating a risk to our systematic positions. We think it prudent to reduce or remove fixed-income risk heading into the event for those with discretionary ability.

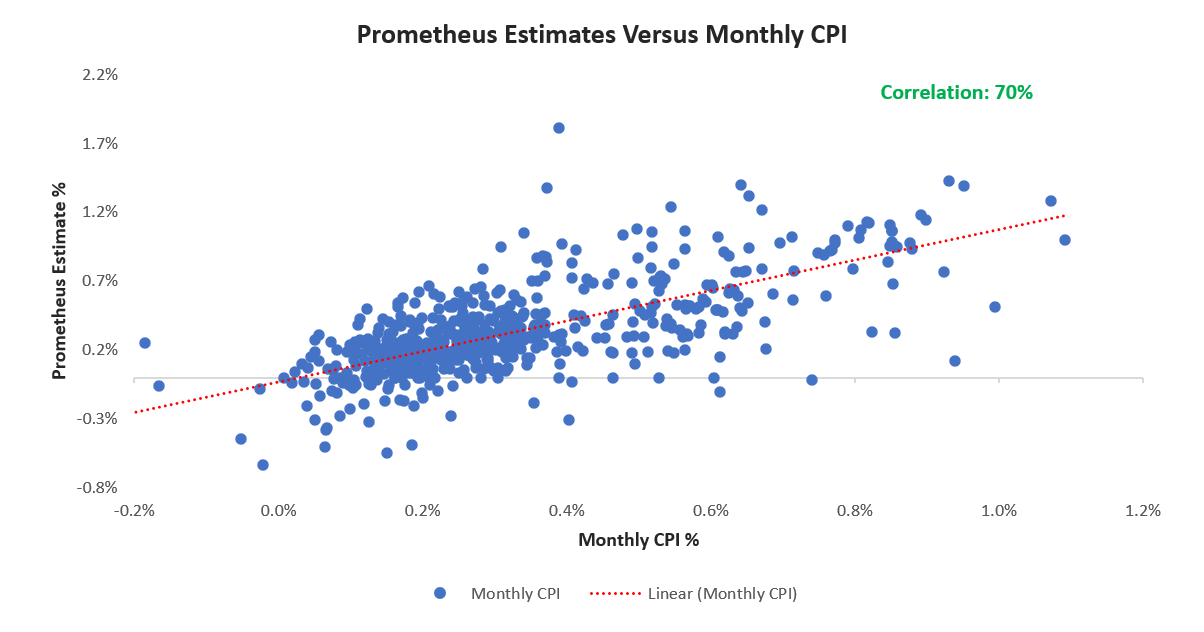

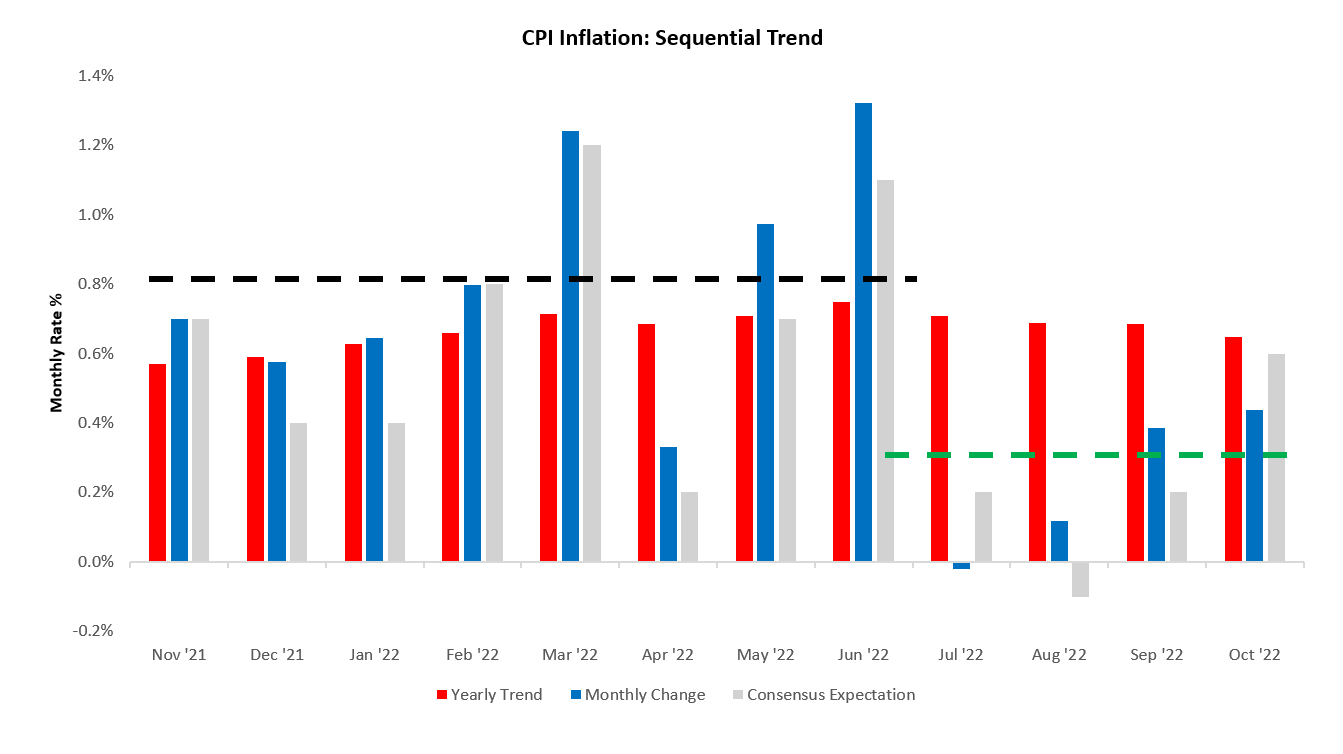

Stepping back from the details on individual prints, we think it is essential for market participants to understand two dynamics. First, if inflation stays within the current range, it remains far beyond the Fed’s stated objective of 2%— which likely means the Fed will have to continue on a restrictive path. This “restriction” can come in the form of larger interest rate hikes, faster interest rate hikes, or the duration of which interest rates are maintained higher. Second, the trend of inflation will determine which of the previously mentioned restrictive actions the Fed will take to tame inflation. Inflation volatility in 2022 was exceedingly high, given geopolitical escalations globally, which impacted global commodity markets. As a result, the underlying trend rate of inflation likely remains unclear for the Federal Reserve. The Fed needs to use monetary policy to solve for the underlying rate of inflation entrenched in the economy, and CPI data in 2022 made it exceedingly hard to ascertain that trend. Below, we show the sequential evolution of headline CPI data over the last twelve months:

Above, we create two lines representing the two potential monthly inflation trends— 0.7% (H1 2022, in black) and 0.3% (H2 2022, in green). Where the inflation trend settles over the next few inflation prints will likely determine how the Fed will conduct policy. The closer we are to 0.7%, the faster and larger interest rate hikes will be. The closer we are to 0.3%, the more the Fed will lean on holding rates where they are to keep conditions adequately restrictive. Reality is likely somewhere in between.

For those interested in a deeper context, we offer our detailed Month In Macro note, which contains the conceptual underpinnings of our systematic process within the context of the latest economic data:

Until next time.

Regressing Prometheus "disagreement with consensus" vs "realized surprise" might be more interesting? AFAIK nearly everyone who tries is able to to get a decent correlation of forecasts to realized. Not to detract from the model, just saying probably can find more compelling datapoints to prove reliability?

Pretty big miss from Prometheus but actually in line with scatter plot spread -- shows 'actual' can go to 0.1% when estimate at 0.39%