Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of both the economy and financial markets in real-time. Here are the top developments that stand out to us:

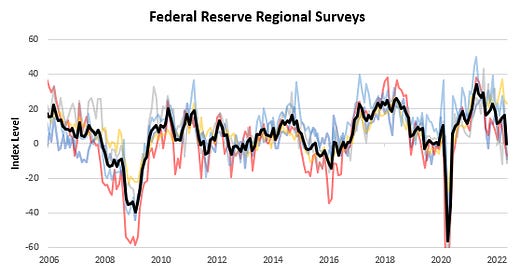

i. Regional surveys of economic activity continue to tell us we are in a slowdown. The Dallas Fed Manufacturing Survey came in significantly lower than expected, with a reading of -7 versus the expected value of 1.5. The average of the regional surveys is now at zero, suggesting that we are at a tipping point for economic growth data.

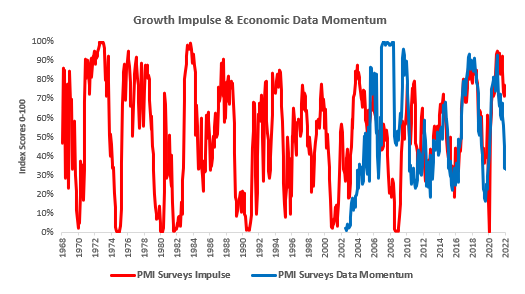

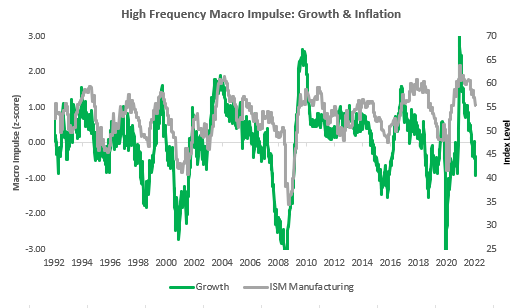

This data is in line with the broad trend in PMIs, which has been decelerating and disappointing expectations, and we show our measures for these below:

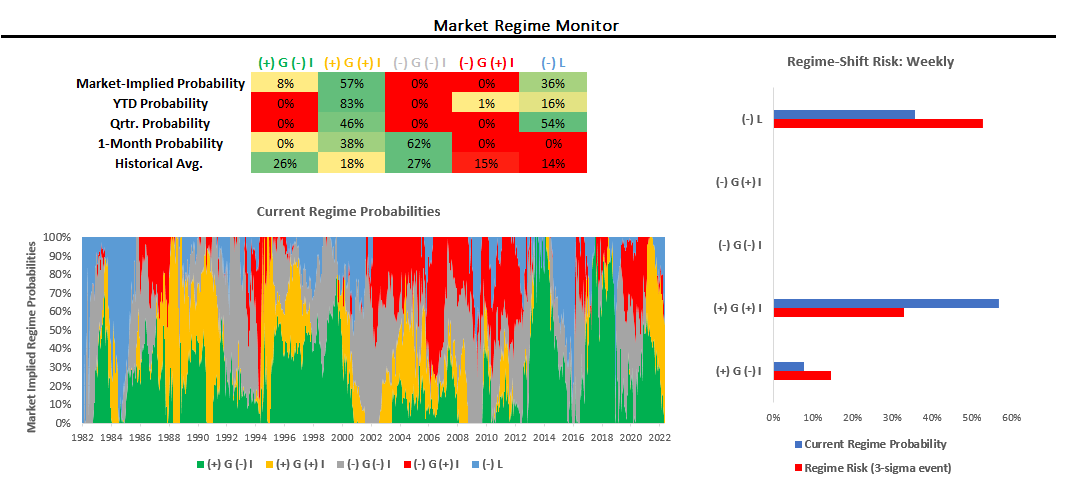

ii. Today, market pricing suggested weakening economic growth, with both commodities and equities down. Stagflationary nominal growth remains the dominant trend in markets; allocate accordingly. We show our market regime monitor below:

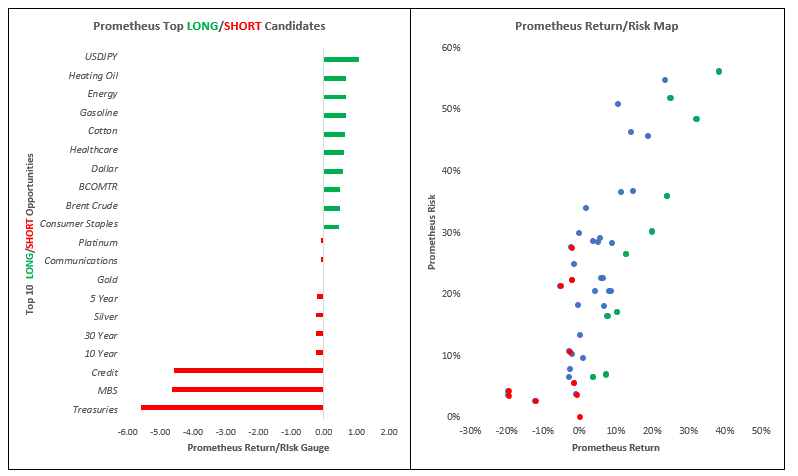

A market regime portfolio would be dominantly allocated to Commodities & Cash. Additionally, our Return/Risk map shows strong short opportunities in fixed income. Our Return/Risk guage uses inputs of trend, regime expected returns, volatility, and correlation to asses te value add of indivdiual positions to a portfolio. We show this below:

iii. We’re watching for ISM data tomorrow and expect a sequential slowdown; there is significant potential for a greater than expected deceleration.

We aren’t in the business of predicting every print of economic data. However, our systems are created to estimate where we are in the economic cycle and to position ourselves optimally within this context. Therefore, while equity markets may have bounced due to technical factors last week, conditions remain unfavorable for exposures that favor rising growth, falling inflation, and abundant liquidity, i.e., equities and credit. Stay nimble!