Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of both the economy and financial markets in real-time. Here are the top developments that stand out to us:

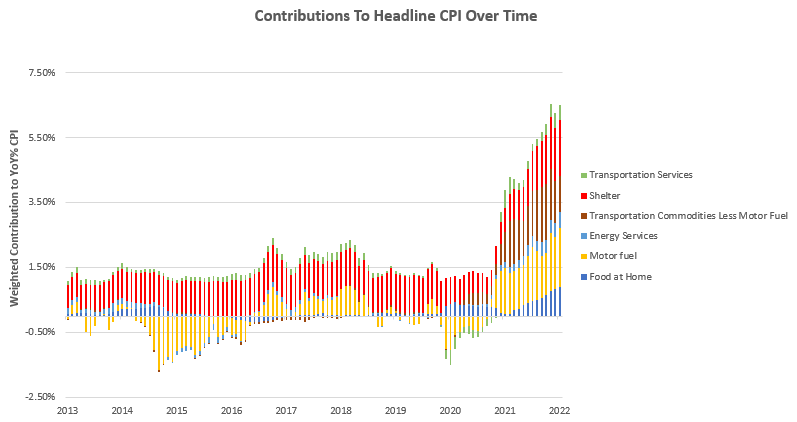

i. Inflation came in higher than expected, rising at a torrid 1% in May alone, benefitting our systematic exposures greatly. Energy, transportation, home prices, rents, and food prices were the largest contributors to these moves. We show the top six categories over time below:

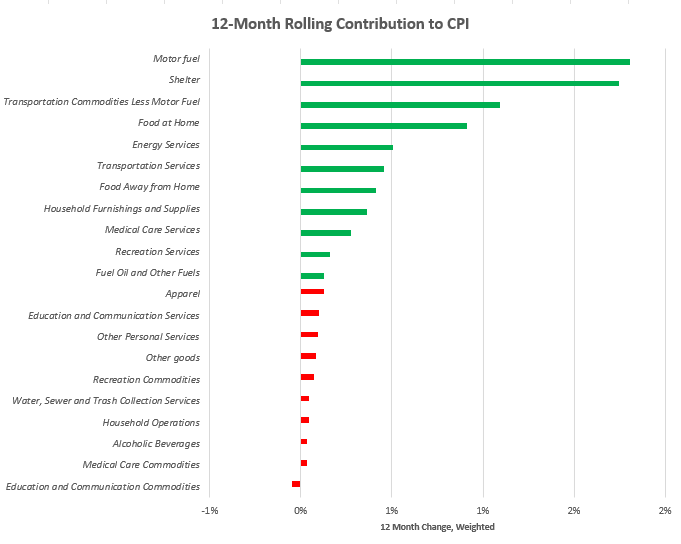

To showcase the contributions to the trends underlying current inflation, we show the contributions to the yearly changes in CPI:

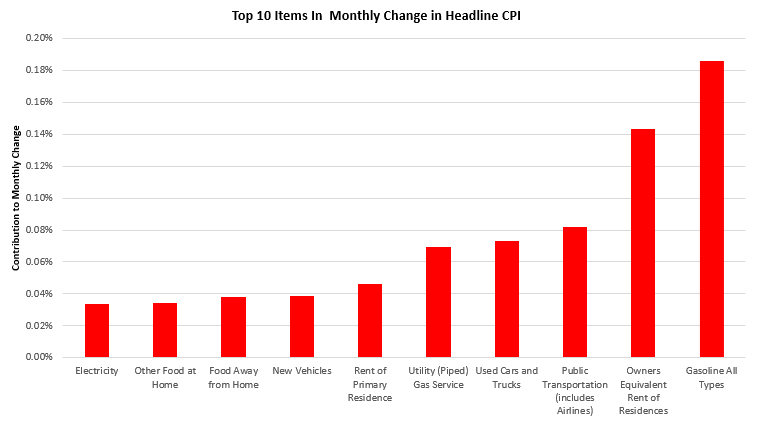

For more specificity, we show the top 10 items that contributed to the current monthly change:

The primary concern we do not feel is adequately appreciated in markets today is that inflationary pressures have spread to items where inflationary tendencies do not revert quickly, i.e., food and housing. With sustained rental inflation, we could see a much higher mean CPI than markets are discounting, which would mean there is significant room for the current downtrend in stocks and treasuries. Our systems tell us to position accordingly, and we continue to short equities and stay long commodities and other inflation beneficiaries.

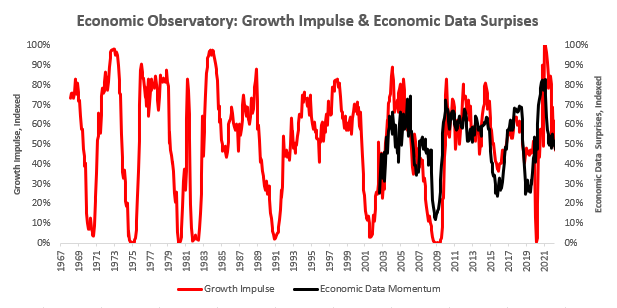

ii. Economic growth continues to weaken, with growth below potential and data disappointing expectations. Our GDP Nowcast currently estimates GDP growth of 0.99%. Further, our GDP Nowcast now shows a negative Growth Impulse, i.e., growth is below trend. Data has recently surprised the downside, with Economic Data Momentum at 47.61%.

Economic growth is currently being held up by robust employment alongside high nominal wages. However, these wages continue to be eroded by inflation. These inflationary pressures also significantly impact profitability, as these rising costs will pressure margins. In the immediate future, we may see some alleviation in pressure on the household sector, mainly from employment gains; however, the room for these improvements remains limited.

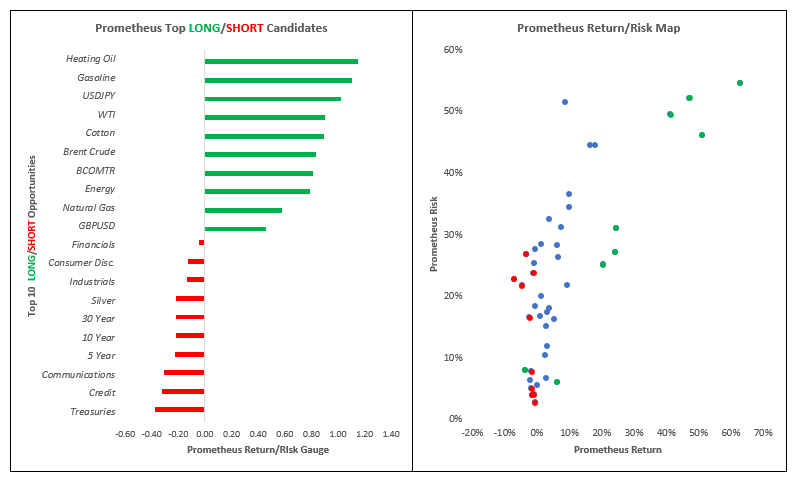

iii. Market regime trends continue to support inflation beneficiaries, i.e., our preferred exposures. Our systems use fundamental economic and market trend data to assess the best exposures for a given environment. Currently, market dynamics have favored betting on rising inflation. We show our rankings below for market trend dynamics:

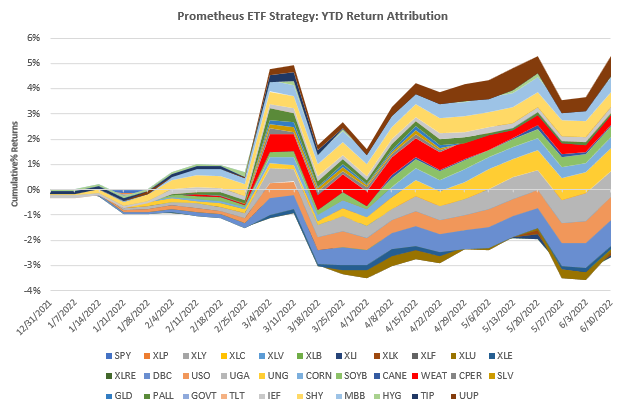

Remember that the above is only one sliver of our investment process and that allocating solely based on this metric will provide less than optimal results. However, we think the degree of trend strength in inflation beneficiaries relative to disinflation beneficiaries is significant and worth noting. Within this context, our ETF Strategy has had a strong week on the back of substantial market pricing of stagflationary risks. We show the year-to-date performance of our ETF Strategy below:

Additionally, we show the full-sample history of the strategy, scaled to match S&P 500 cumulative returns. Our objective is to provide strong return-on-risk characteristics and then leave the choice of leverage and risk to our users:

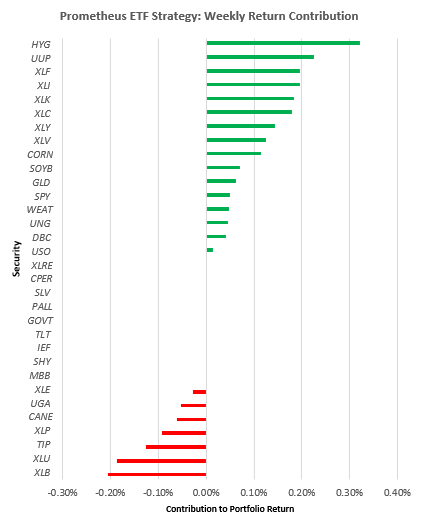

Over the last week, our top performers were credit shorts (HYG), dollar longs (UUP), & various equity shorts. This week was a solid one for both long and short positions.

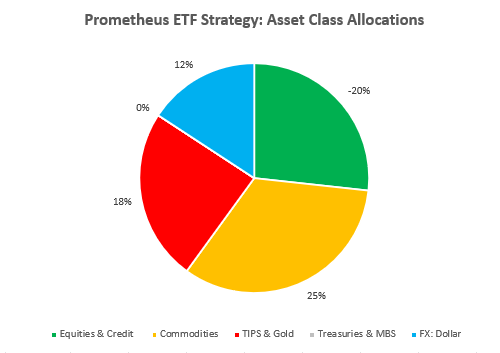

Turning to next week, here’s how our systems are looking to position our ETF Strategy at the asset class level:

At the security level, here is how our systems are positioned:

Stocks: SPY (-5%), XLP (5%), XLY (-3%), XLC (-5%), XLV (-5%), XLB (5%), XLI (-5%), XLK (-4%), XLF (-4%), XLU (5%), XLE (3%)

Commodities: DBC (4%), USO (3%), UGA (2%), UNG (2%), CORN(3%), SOYB(4%), CANE(4%), WEAT(2%), GLD (6%)

Fixed Income: HYG (-9%), TIP (13%)

Dollar: UUP (12%)

Our Alpha Strategy has performed well in this environment and will offer updates on the same in our Week Ahead note this weekend. Stagflation continues to challenge those who have only seen/anticipated a continuation of secular deflation. Risk mitigation remains the number one priority for traditional allocations, and we expect our systems to continue to lead the way. Stay nimble.