Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of both the economy and financial markets in real-time. Here are the top developments that stand out to us:

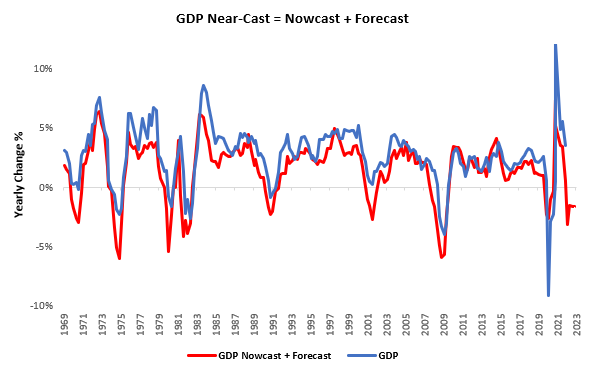

i. It is highly likely we are headed towards a recession. Arguably, we are already in one and will receive data confirming or denying the same tomorrow. Our economic data tracking places us at approximately 0.7% Real GDP growth versus a year ago. We show this below, along with our forecast for GDP:

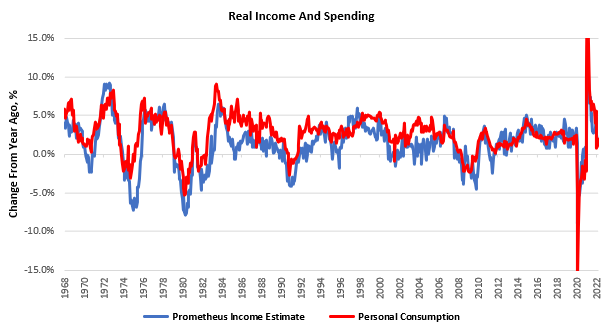

Tomorrow, we will receive income and spending data from the US government, which is essential to our GDP Nowcast. With nominal wages and employment still elevated, there is potential for support for real consumer spending. What remains to be seen is whether consumers choose to save marginal income gains or spend it. We show our estimates for income alongside personal consumption expenditures below:

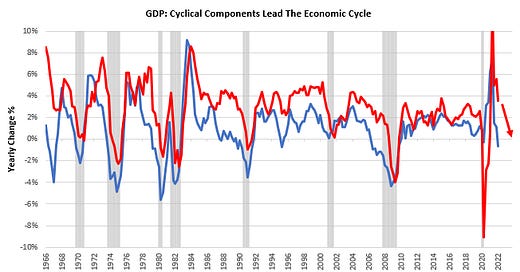

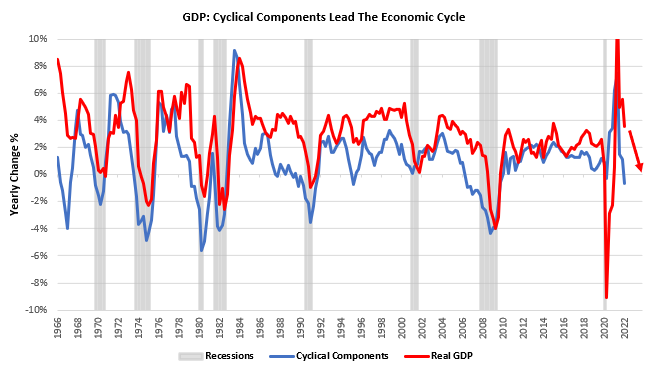

However, looking under the hood of GDP data, we see a significant cause for concern. The US economy is prototypically consumer-dominated, with 69% of GDP coming from consumer spending alone. The consumer tends to be sensitive to both stages of the economic cycle and credit availability. During late-cycle periods, with interest rates rising to keep up with inflation, household spending on items that require borrowing (automobiles and housing) tends to weaken significantly as prospects for the rest of the economy begin to decline. We aggregate these components to show how cyclical components of GDP lead GDP cycles:

The average lead time for a decline in cyclical spending to translate into a recession is approximately three months. These lead times are not immutable laws but rough guidelines. However, we expect this decline in cyclically sensitive spending to translate into lower business revenue and pull down GDP growth. The latest reading of this measure implies a recession over the next six months.

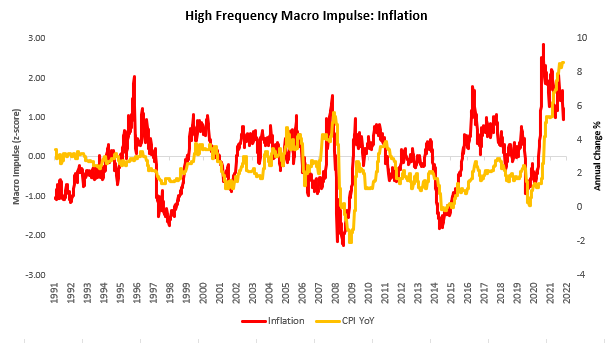

ii. Inflation has begun its descent; however, it remains far above levels comfortable for equity and credit markets. Our proprietary tracking of inflationary pressures suggests that inflation will begin to recede over the next few months. However, unless the pace is truly sensational, the level of inflation we are currently experiencing remains highly problematic for markets.

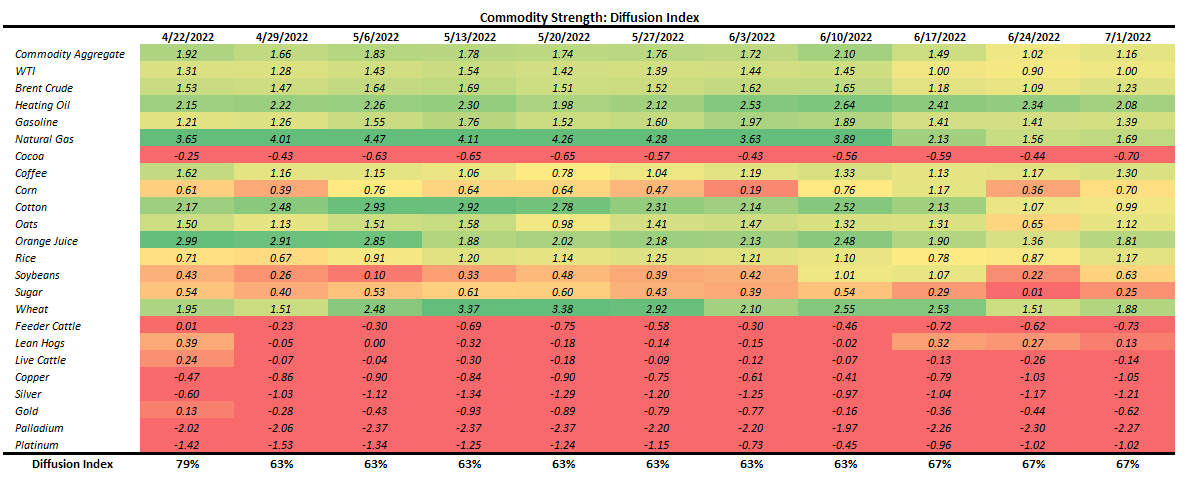

A significant amount of these winning pressures will come from the pass-through of commodities into the cost structure. Make no mistake; prices will continue to rise at an uncomfortable rate, just a slower one than we are currently witnessing. We show the degree of commodity strength remains elevated, albeit significantly less than earlier this year:

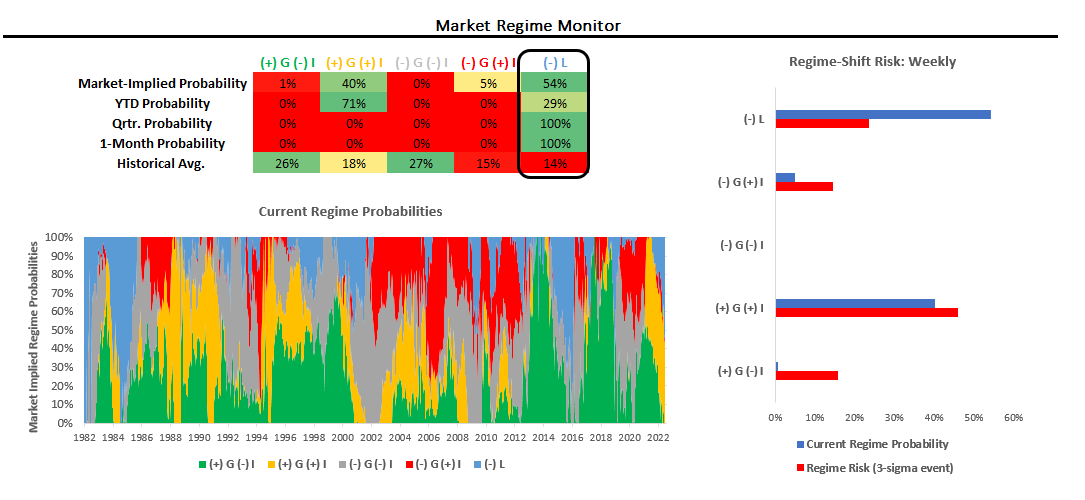

iii. Tightening liquidity conditions dominate markets, making capital preservation the most important thing. We show our market monitor below:

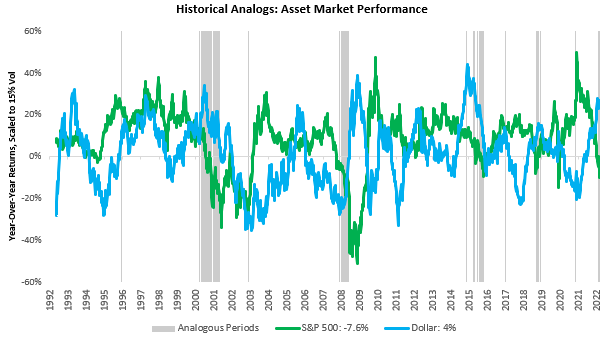

This mix of stagflationary-liquidity tightening remains a bane for stocks that need both liquidity (for valuations) and real growth (for earnings). In the current environment, they get neither. Our analog finder, which looks for periods that resemble the present based on economic and market dynamics, tells us the S&P 500 has an annualized expected return of -7.6%. This is not a time to be buying dips.

Conversely, the dollar has a 4% expected return, and when we adjust for the fact that it typically has far lower volatility than stocks, there emerges a clear winner. If you can’t trade currencies or short, raise cash. There will come a time to reverse these positions, but we won’t be there for a while. Stay nimble.