Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real-time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

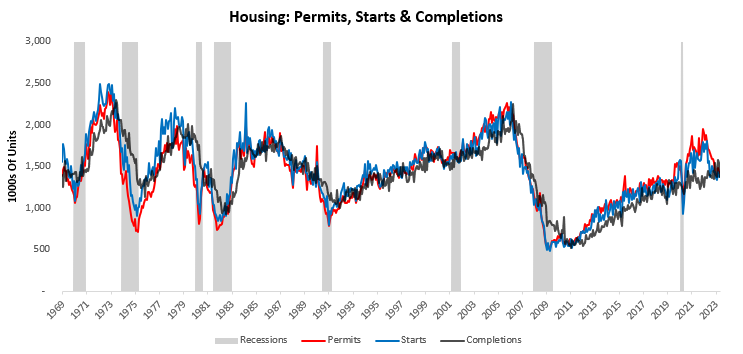

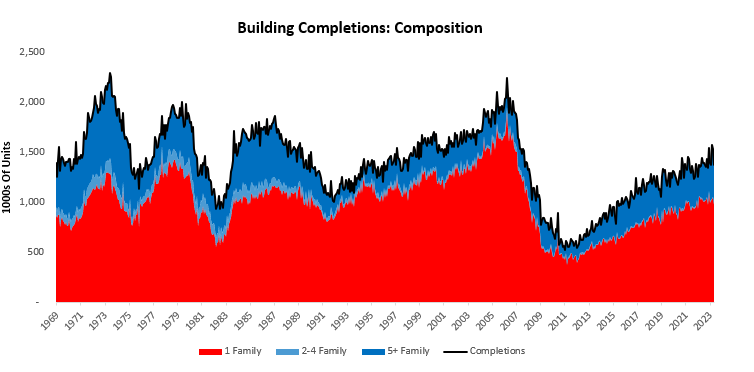

Yesterday, we received new incremental information in the form of housing data. On the surface, this data showed mixed readings. However, a more careful dissection suggests continued weakness in the housing sector. We have seen extreme volatility in recent housing data; however, despite this volatility, the trend is lower and remains intact. We expect this to continue to impact future GDP negatively though there is potential for construction backlogs to add to the GDP picture. Nonetheless, with permits and starts sustaining a downward trend, it is unlikely back construction backlogs will be additive as we progress through the year.

The latest data for April showed housing permits decreased by -1.46%, housing starts increased by 2.19%, and housing completions decreased by-10.37%. Below, we show the current levels for the same:

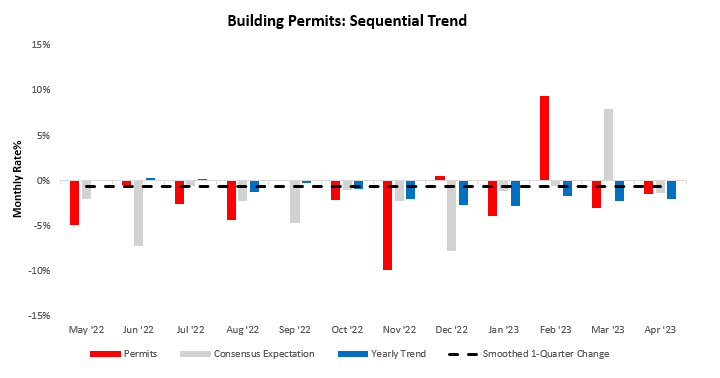

Zooming into the data, housing permits decreased by -1.46%, disappointing consensus expectations of -1.38%. Below, we show the sequential evolution of the data, along with the smoothed one-quarter change in the most recent data. We provide the smoothed version as monthly housing data contain significant noise.

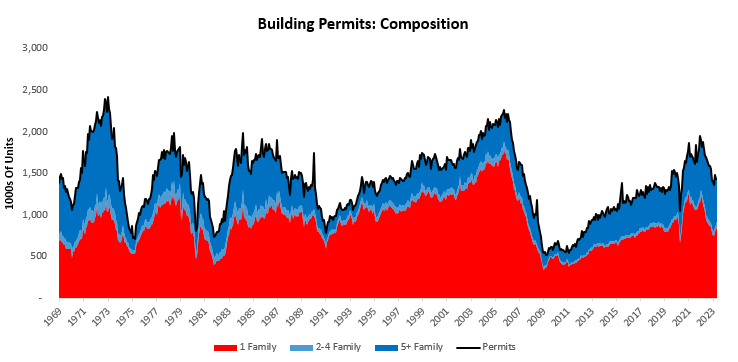

For further context, we zoom out to show the contributions from single-family homes (-230), two-family homes (1), and multi-family homes (-150) to the fall (-379) in total permits over the last year:

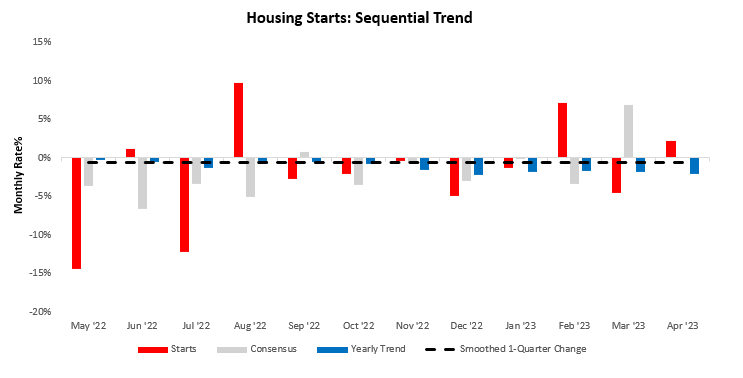

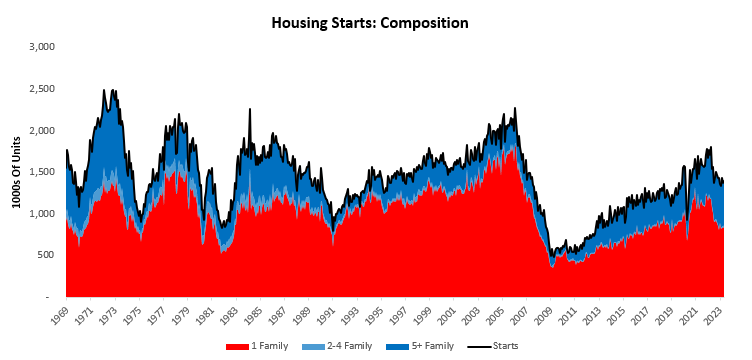

In contrast to the permits data, housing starts data showed starts increased by 2.19%, surprising consensus expectations of 0%. Below, we show the sequential evolution of the data, along with the smoothed one-quarter change in the most recent data. We provide the smoothed version as monthly housing data contain significant noise.

To illustrate the bigger picture, we show the contributions from single-family homes (13), two-family homes (0), and multi-family homes (-72) to the fall (-402) in total starts over the last year:

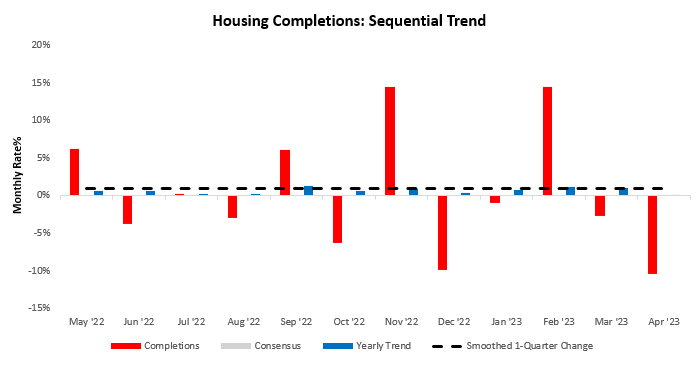

Last, in our sequential analysis, we turn to housing completions data, which showed completions decrease by -10.37%. Below, we show the sequential evolution of the data, along with the smoothed one-quarter change in the most recent data. We provide the smoothed version as monthly housing data contain significant noise.

We show the contributions from single-family homes (-68), two-family homes (-11), and multi-family homes (78) to the rise (14) in total completions over the last year:

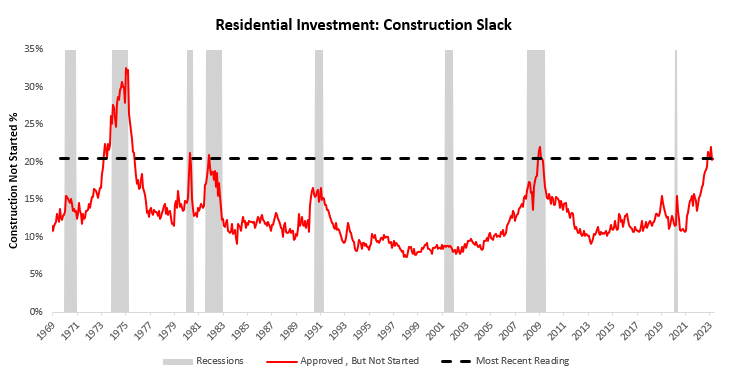

To get a better sense of where we are in the housing cycle, we examine how many construction projects have been approved but not yet started. According to the latest data, 20% of projects are yet to begin construction. Looking through history, housing-led recessions usually begin when this measure of construction slack is around 15% suggesting that we are within the ballpark of a recession.

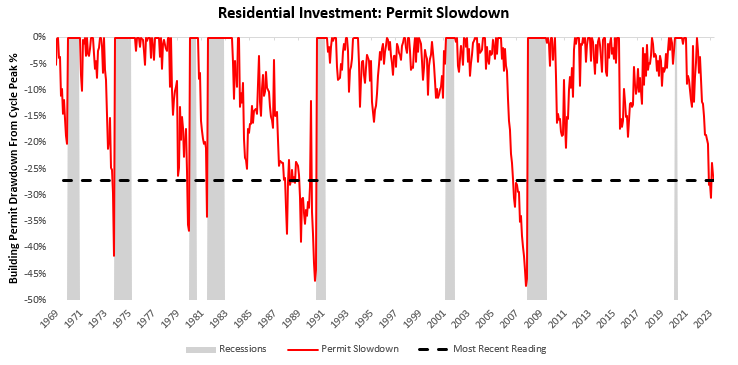

We conclude by examining another measure of housing weakness, i.e., permit slowdowns- which measures how much building permits have fallen from their cycle highs. Large drops in permits bode ill for the broader residential investment complex & GDP. The latest data shows that building permits are off their cycle highs by -25%. Typically, housing-led recessions usually begin when this measure of cyclical weakness is around -25% suggesting that we are within the ballpark of a recession.

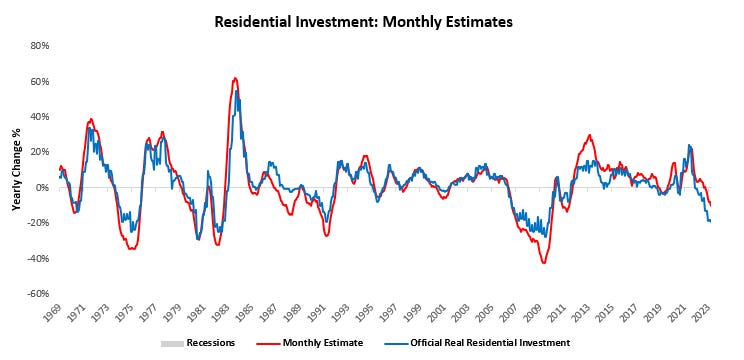

Overall, our estimates of real investment remain in contractionary territory & given cyclical dynamics, are unlikely to move upwards materially. Recent volatility in certain segments of housing data may suggest otherwise; however, looking through the details, we continue to expect that there will remain weaknesses ahead. Our latest monthly estimate places real residential investment at -11.6% versus one year ago, a sequential worsening from the prior reading of -10%:

While we think it is important to keep track of the sequential data and have an entire process built around tracking it, we think it is important also to step back and look at the cyclical context. Housing may be better relative to recent months; however, it remains in a downturn, which typically has implications for the broader economy. Until next time.