Welcome to our official publication of the Prometheus ETF Portfolio. The Prometheus ETF portfolio systematically combines our knowledge of macro & markets to create an active portfolio that aims to offer high risk-adjusted returns, durable performance, & low drawdowns. Given its systematic nature, we have tested the Prometheus ETF Portfolio through decades of history and have shown its durability. For those of you who are unacquainted with our systematic process, we offer a detailed explanation here:

In this publication, we will discuss the performance, positioning, & risks of the Prometheus ETF Portfolio— and it will be published every week on Fridays to help investors understand how our systematic process is navigating through markets. Before diving into our ETF Portfolio positions, we think it is important for subscribers to understand the context within which our systems choose their exposures. Below, we offer our latest Month In Macro note, which contains the conceptual underpinnings of our systematic process within the context of the latest economic data:

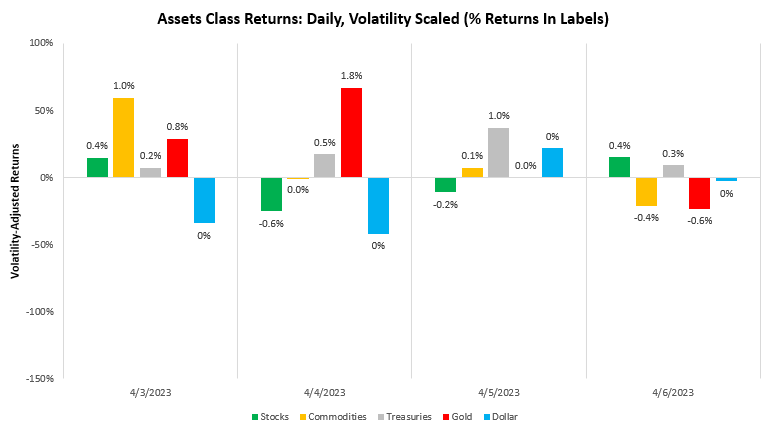

As detailed in our Month In Macro note, we believe that the pressures on growth have accumulated and are now likely to cause a downturn in economic activity. This growth dynamic will likely make economic growth the dominant driver of asset returns in 2023 versus inflation, which was the dominant driver of returns in 2022. Within this context, our systematic Prometheus ETF Portfolio has come to prefer falling growth expressions, i.e., long treasury securities and short stocks. This week proved a positive one for such expectations. Bonds were generally positive, and gold well-supported:

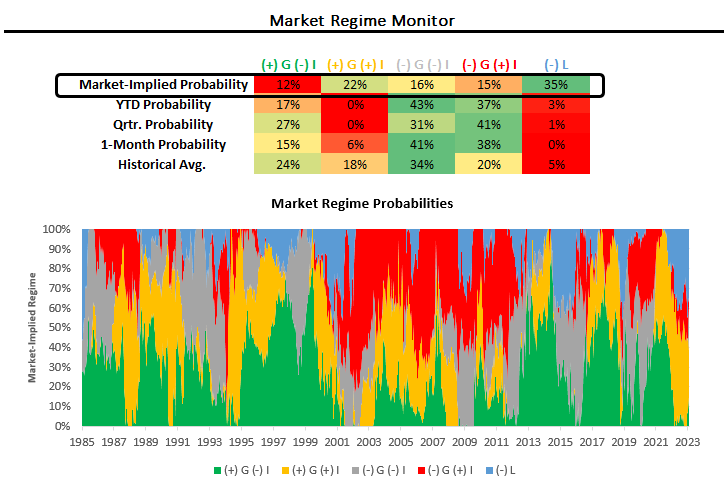

Unfortunately, we were unable to provide portfolio specifics heading into this week due to the team’s travel schedule, but we hope the big-picture guidance on this front helped you navigate a positive week. Overall, markets moved to price falling growth, which continues to accumulate into our market regime monitors:

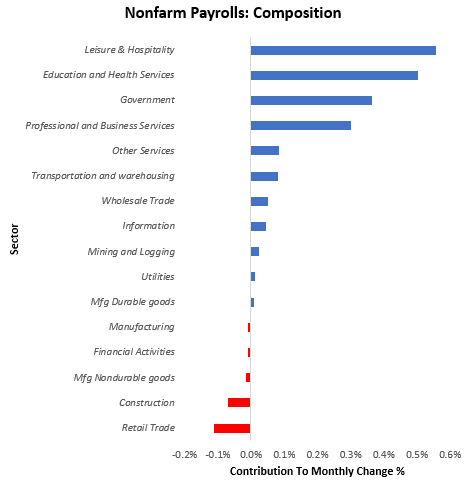

With regard to economic data, many financial markets are focused on labor market data to confirm a slowdown in activity. The headline number for nonfarm payrolls was 0.15% versus the prior month. Looking through the composition of the print, we have seen cyclical components of the economy weaken in March, as shown below with the red bars:

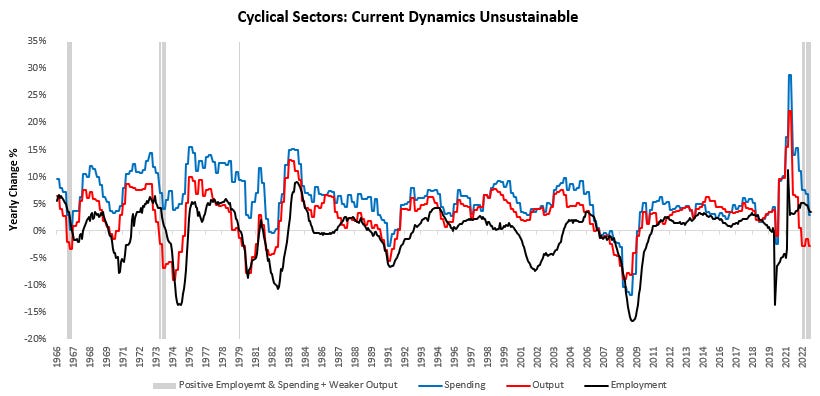

Zooming out, the gap between activity in cyclically sensitive parts of the economy and their employment remains large, and therefore the pressure on employment remains in place:

Spending on the cyclical sector remains positive in nominal terms, but the output is contracting. The purpose of employment is output, and as real demand continues to weaken, employment is likely to follow.

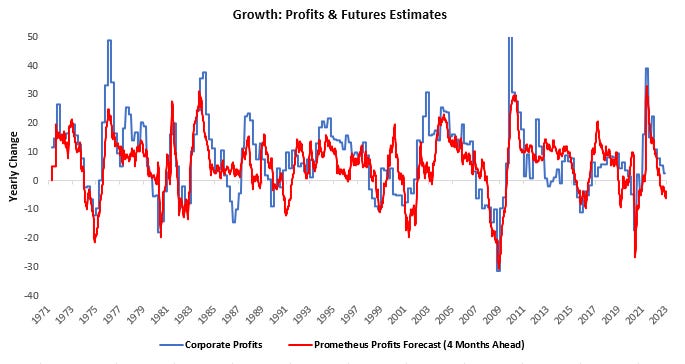

Furthermore, we think it is important for the shoe to drop before employment will be corporate profits, and therefore an excessive focus on the lack of significant labor weakness is likely to lead to both misdiagnosis and frustration. Regarding future profitability, we see several significant headwinds in place.

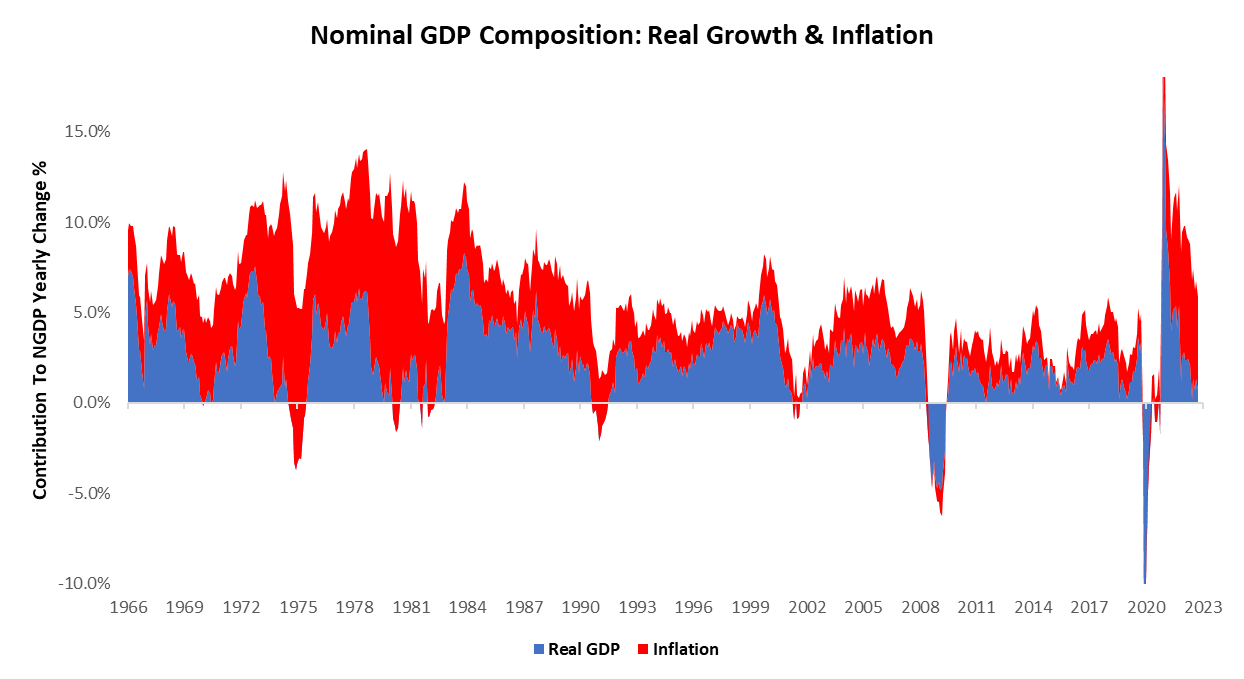

Nominal GDP has decelerated, consistent with weaker topline sales:

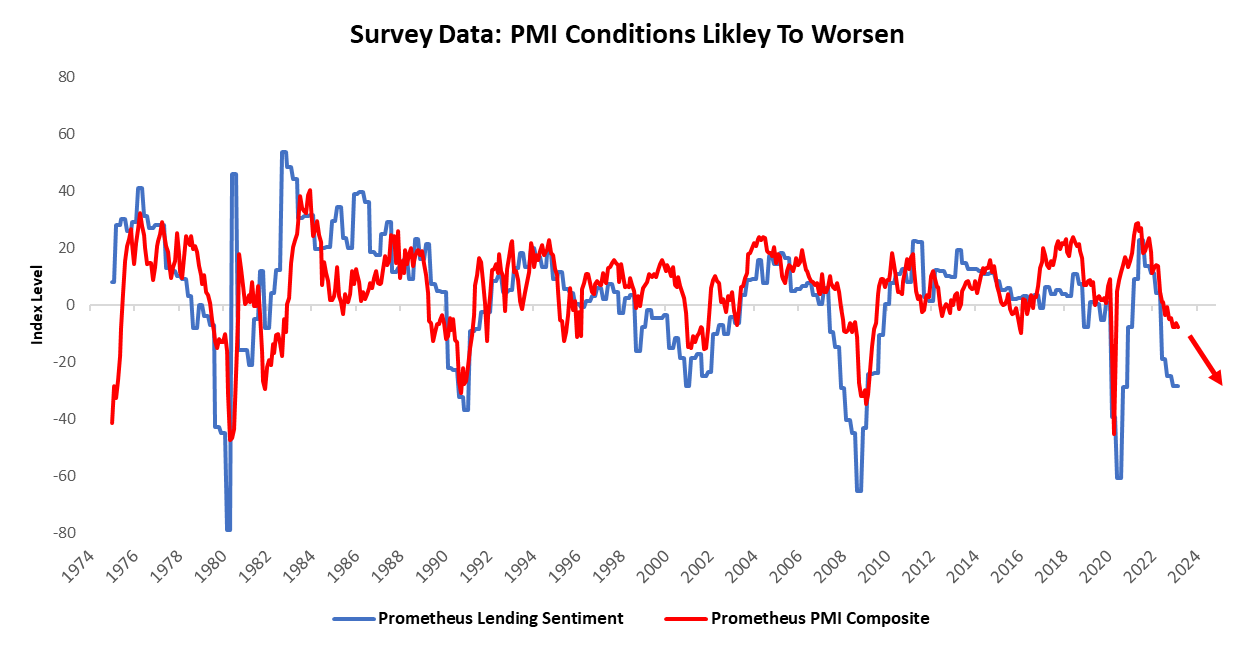

Measures on business sentiment have declined, implying weaker leverage and investment conditions:

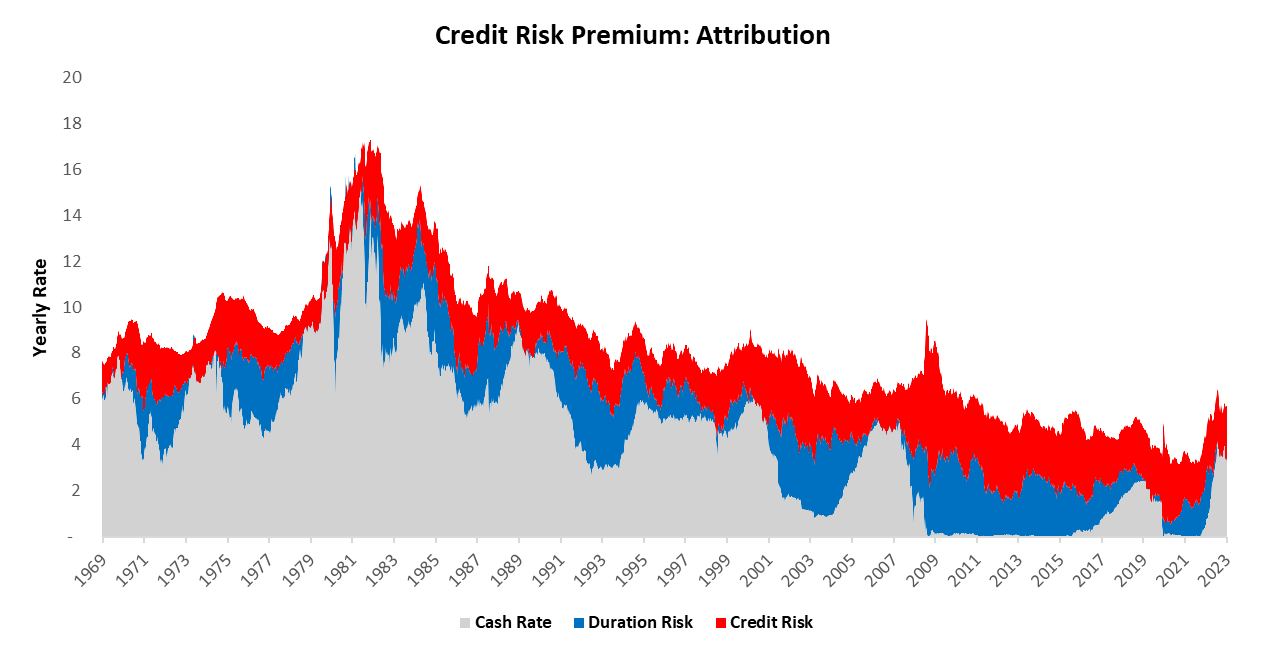

Borrowing costs are elevated:

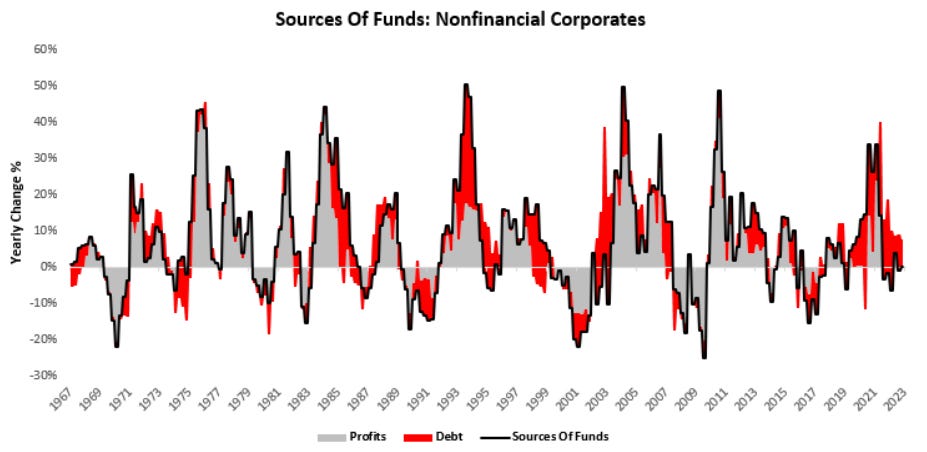

And existing sources of funds have declined:

Therefore our expectation is the current pressure on profitability is likely to extend itself, worsening existing profit pressures:

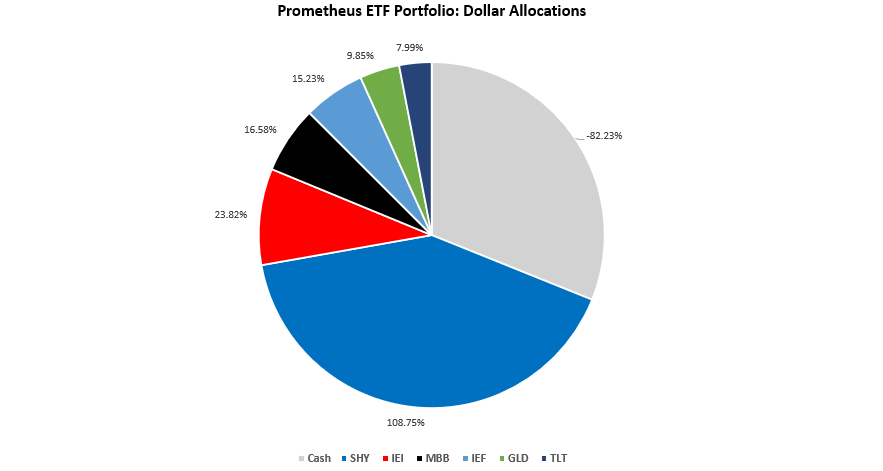

Within this expected backdrop, our systems are looking to allocate the Prometheus ETF Portfolio as follows next week:

POSITIONS: Cash: -82.23% SHY : 108.75% IEI : 23.82% MBB : 16.58% IEF : 15.23% GLD : 9.85% TLT : 7.99%. Please note that the short cash position implies leverage.

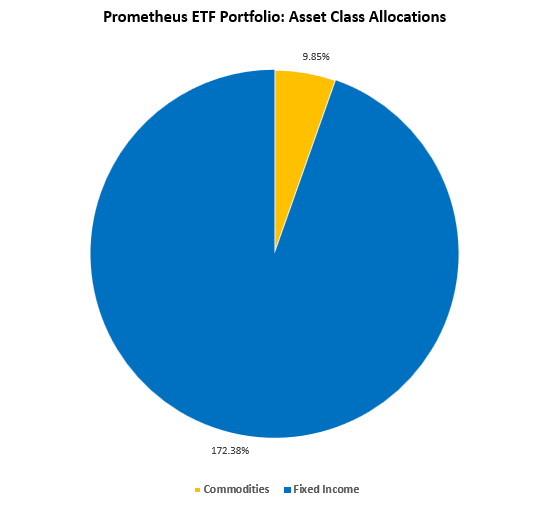

At the asset class level:

This portfolio allocation has an expected volatility of 8.7%, with a maximum expected volatility of 10%. Heading into next week, the primary risk to these positions come from CPI, which will be released on Wednesday. Prior to the print, we will try to provide updated guidance— however, we are undergoing extensive upgrades to our systems, so please bear with us if we cannot do so, it will be worth it. Overall, our expectations remain that downside growth volatility will be the driver of asset class returns. Thus far, 2023 has followed this expected path, and we continue to monitor closely. Until next week.

I agree with the slowing growth but isn't the 2 year already pricing in dramatically rapid cuts already? Are your systems counting on something even more black swanish as the base case to be levering up on SHY?

Can you give some insight into how you're employing leverage?