Welcome to Prometheus ETF Portfolio. The Prometheus ETF Portfolio aims to allow everyday investors to access an investment solution that combines active macro alpha, passive beta, and strict risk control, all in an easy-to-follow, low-turnover solution. We aim to achieve strong risk-adjusted returns relative to cash, with limited capital drawdowns in depth and duration. We do this in a highly accessible package, which rotates between three highly liquid ETFs, readily available to any investor with a brokerage account.

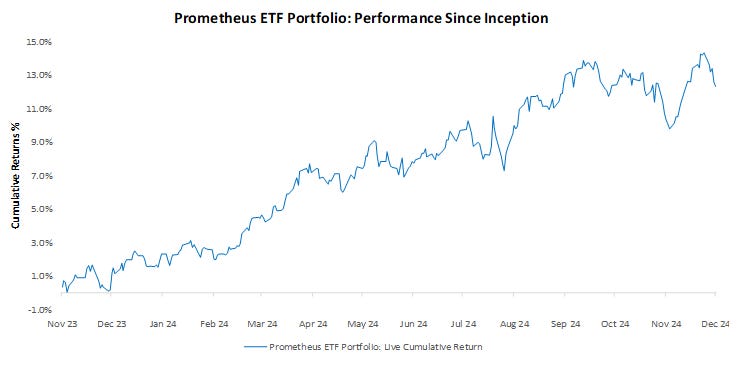

We visualize our live performance below:

Turning to our latest ETF Portfolio update, our latest observations are as follows:

Market Monitor: Last week, markets moved to price inflationary outcomes. This pricing is inconsistent with what we see in the economy. We continue to expect the economy to expand, with growth and inflation outcomes capped to the upside.

Economic Data Monitor: Economic data softened this week. This week's growth data was relatively light, and jobless claims surprised to the upside. CPI data came in modestly ahead of expectations. While the latest CPI data moved the data trajectory for CPI upwards over the next twelve months, the fundamental drivers remain a downward force.

ETF Portfolio Positions: Heading into next week, our Prometheus ETF Portfolio program will be looking to position as follows: