Welcome to Prometheus ETF Portfolio. The Prometheus ETF Portfolio aims to allow everyday investors to access an investment solution that combines active macro alpha, passive beta, and strict risk control, all in an easy-to-follow, low-turnover solution. We aim to achieve strong risk-adjusted returns relative to cash, with limited capital drawdowns in depth and duration. We do this in a highly accessible package, which rotates between five highly liquid ETFs, readily available to any investor with a brokerage account.

Without further ado, let us dive into our assessment of macroeconomic conditions:

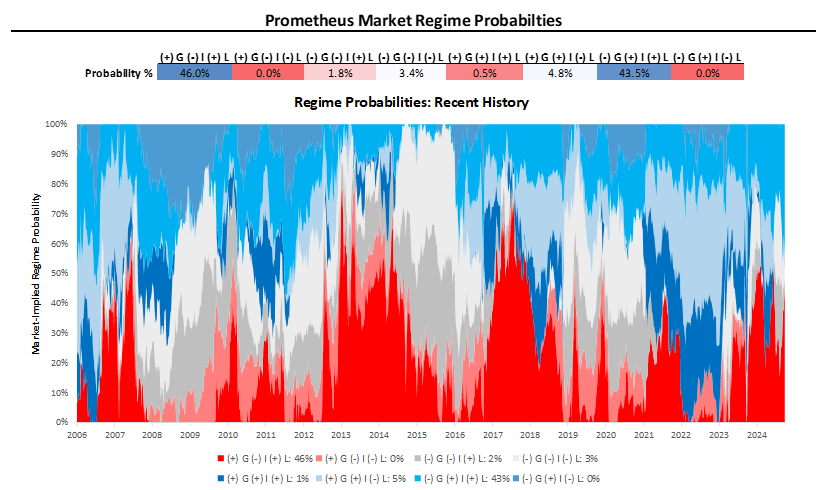

Market Monitor: Over the last week, markets continued to price in marginally higher inflationary pressures, which weighed on stocks and bonds. This price regime continues to look like an idiosyncratic one, dominated by oil price shocks emanating from Middle East tensions. Looking at the economy, we do not see accelerating demand for commodities like oil, which will likely make this regime transient.

Economic Data Monitor: Economic data momentum rose significantly this week. Jobless claims, home sales, and manufacturing orders all surprised. However, it is important to note that the latest data from housing, industrial production, transport, and orders have continued to show softness. Signs of cyclical weakness now exist in the economy and are something to monitor carefully.