At Prometheus, innovation has been the cornerstone of our evolution, and we're constantly pushing forward our understanding of macroeconomic dynamics to further our edge in markets. A key driver of this evolution is our iterative research process, where we try to systematize our ongoing understanding of macro conditions into investment strategies. Keeping with this process over the years has allowed us to improve our process substantially and create our next generation of programs: Alpha Strategies.

Alpha Strategies reflects the best parts of our understanding of macro, markets, and portfolio construction. The purpose of Alpha Strategies is simple: to provide durable and consistent return streams independent of beta. These strategies span equities, fixed income, and commodities, combined into a single portfolio accessible exclusively to Prometheus institutional clients. This primer will discuss the simulated strategy profile to contextualize our upcoming daily Alpha Strategies reports. Let's dive in.

Alpha Strategies: Process

Alpha Strategies aims to use our understanding of markets to create an approach to investing that produces durable performance across economic cycles. We seek to achieve this outcome using our proprietary approach to the economy & markets to trade macro assets in a manner that is independent of beta. Beta is a risk parity combination of stocks, bonds, and commodities, where our process begins. Specifically, our strategies combine the S&P 500, an equal-weighted 10-year & 2-year Treasuries blend, and the Bloomberg Commodities Index to create our base Beta Portfolio. Our systems then seek to take long and short positions in these assets and combine them consistently with our desired level of risk. These positions move up and down based on the degree of signal and our portfolio risk scales to keep drawdowns controlled. Below, we visualize the process our systems go through to move from Beta to Alpha:

Our systems go through this process daily, ingesting new economic and market data and constantly adapting to new information. To protect our edge in markets, we cannot share the specifics of our process; however, the intuitions behind our reasoning are provided in all our publications.

Alpha Strategies: Summary Statistics

Now that we have outlined our process, we dive into the strategy profile. Prometheus Alpha Strategies is designed with the following investment principles:

Achieve a high return-to-risk ratio over a long-term time frame, independent of the performance of beta.

Maintain a volatility consistent with the long-term volatility of equity markets.

Control drawdowns to continuously compound capital from a higher base.

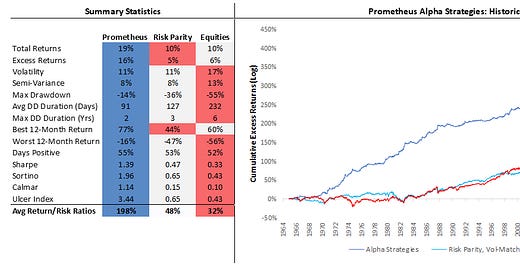

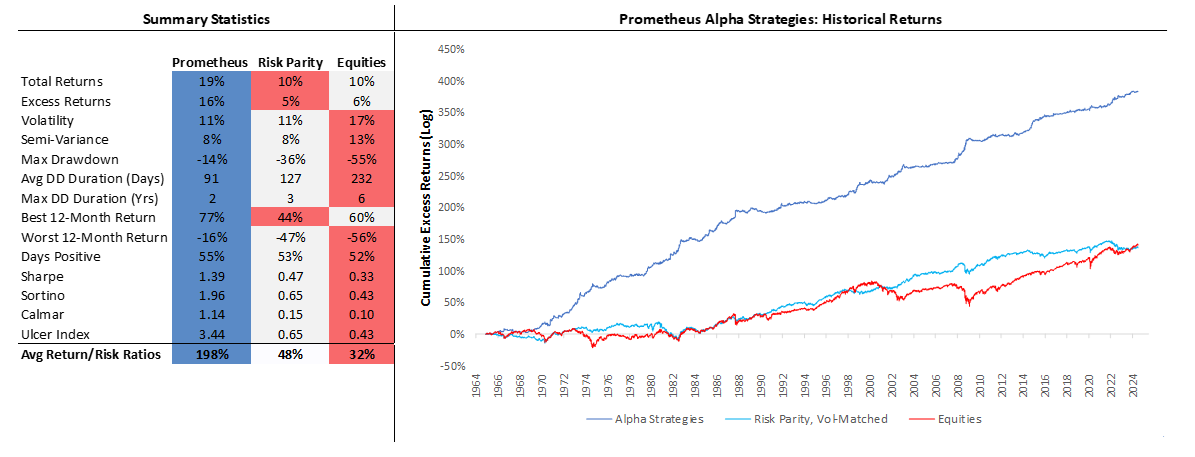

Our systems are designed in line with these principles and simulated from 1965 to the present. We visualize the summary statistics for this simulation below:

As we can see above, Prometheus Alpha Strategies has outperformed both our beta portfolio (Risk Parity) and equity exposure across all dimensions- with higher returns, lower drawdowns in-depth and durations, and across measures of risk-adjusted returns. In the following pages, we look through the performance statistics most relevant to evaluating the consistency of the portfolio with our objectives.

Alpha Strategies: Rolling Returns

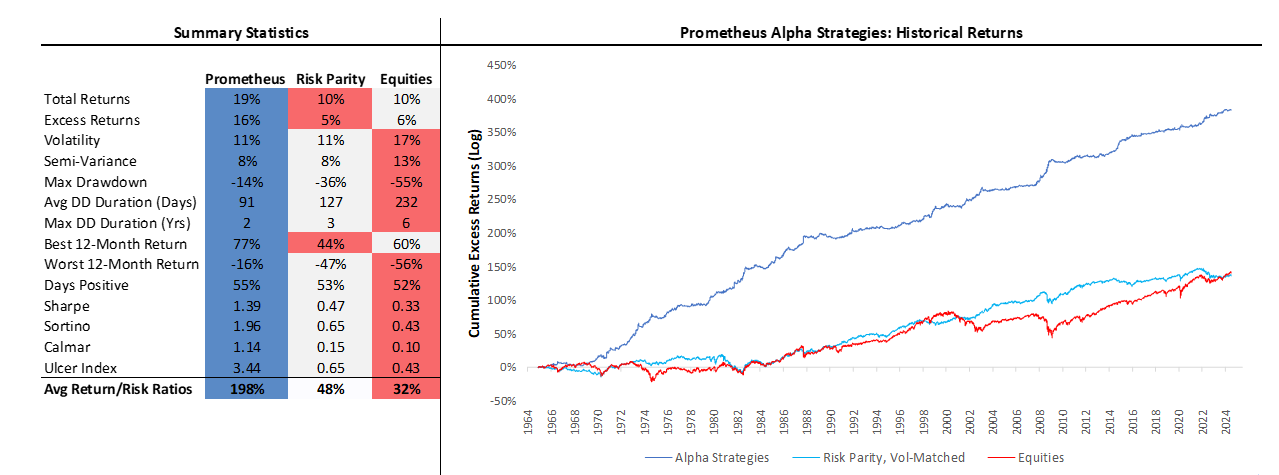

We begin with the most basic assessment level, examining the strategy's rolling returns relative to a risk parity portfolio at equal volatility. This perspective lets us understand whether our strategy has been independent of beta over long periods. Also, it helps us understand whether the returns have been evenly distributed over the years.

As shown above, our Alpha Strategies have been negatively correlated to a Risky Parity Beta Portfolio, suggesting a lack of long-term dependency on the performance of stocks, bonds, or commodities. Furthermore, returns have been consistent, particularly delivering returns as beta underperforms. The strongest year for the strategy was 77%, while the worst year was -16%, reflecting our systematic risk management.

Alpha Strategies: Macro Regime Return Study

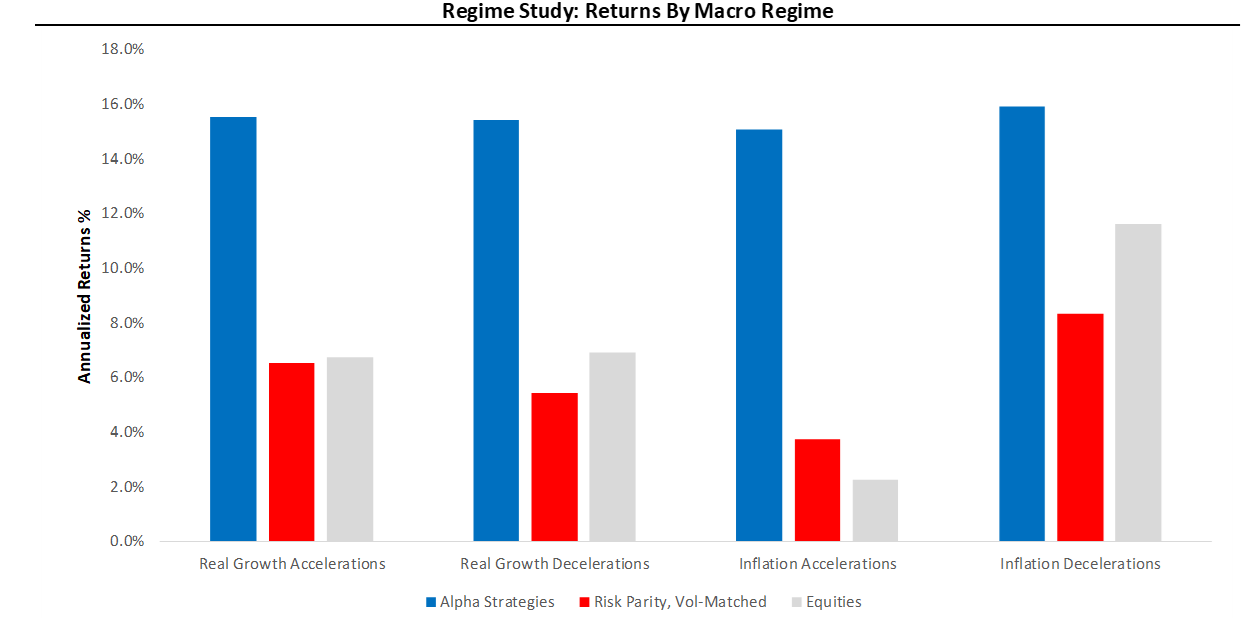

For a further understanding of the durability of our strategies approach, we examine the cumulative excess returns of our Prometheus Alpha Strategies during different macroeconomic regimes. Particularly, we examine the performance of our strategies during periods of acceleration and decelerating inflation. These regime definitions, while broad, also neatly account for recessions, stagflation, and rate-hiking cycles, all the while maintaining a significant sample. We also provide the regime returns for our Risk Parity Portfolio and Equities for context.

As we can see above, Prometheus Alpha Strategies have shown consistent returns across regimes, unlike Risk Parity or Equities.

Alpha Strategies: Macro Regime Return Study

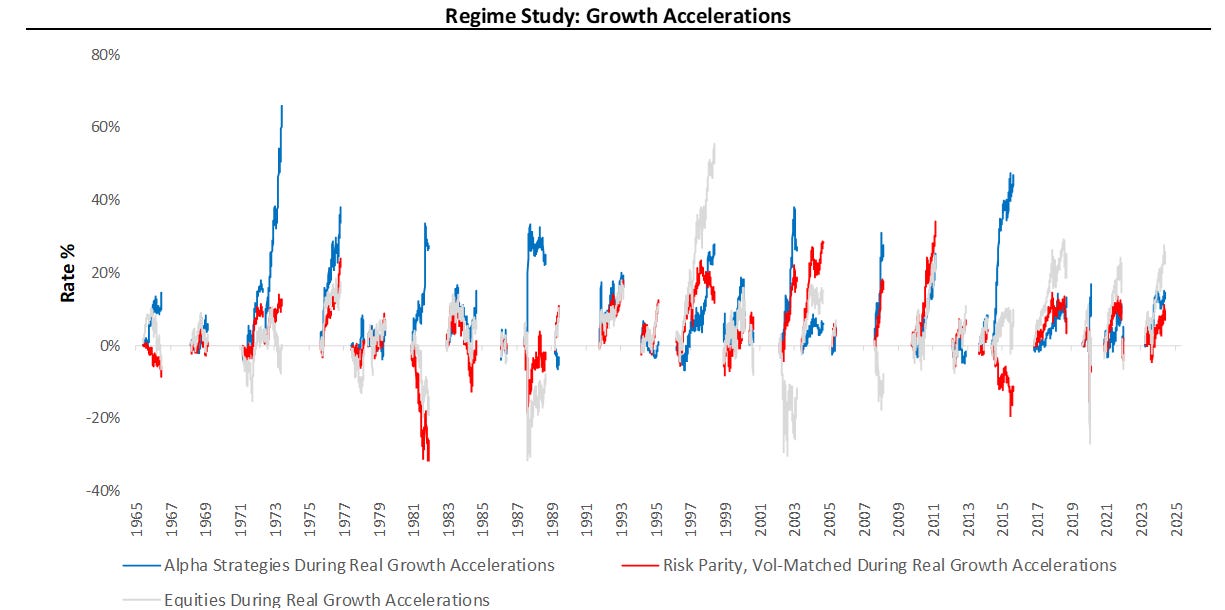

We examine each regime individually, beginning with growth accelerations. We think this is an important starting point for evaluating macroeconomic strategies that possess downside alpha. Often, active alpha strategies can significantly lag equities and beta portfolios during periods of macroeconomic stability or growth accelerations. As such screening for these environments to ensure our strategies can continue to provide returns during these times is essential:

As we can see, our simulated Alpha Strategies have consistently provided positive expected returns during growth accelerations.

Alpha Strategies: Macro Regime Return Study

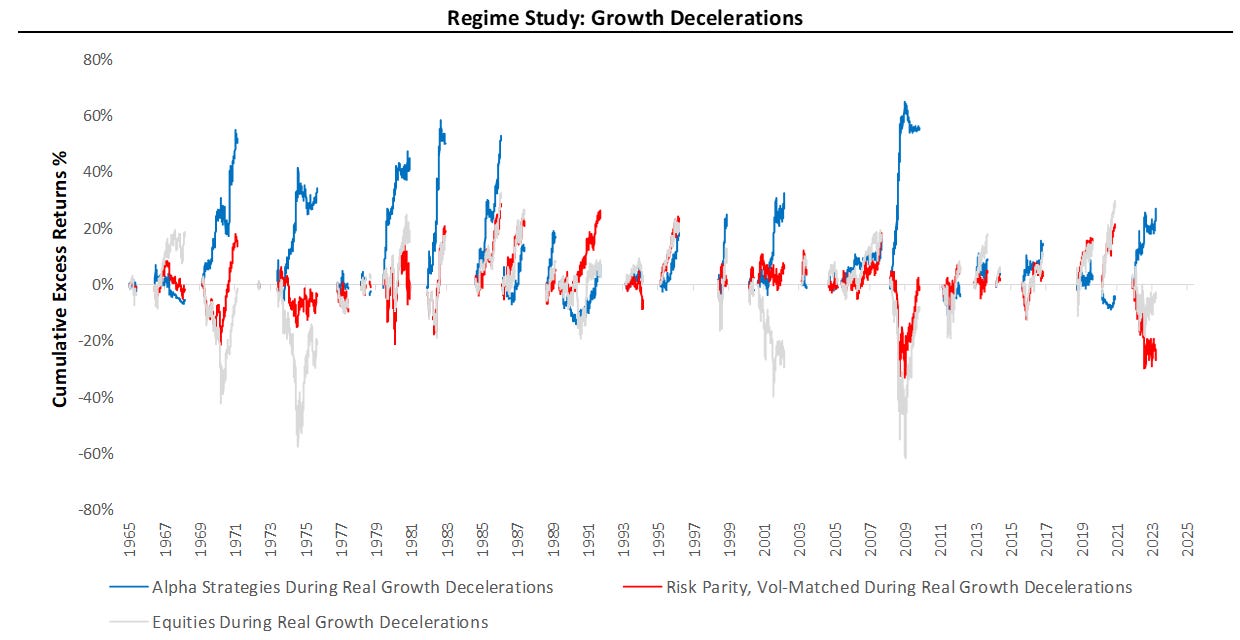

Now that we have examined our simulated performance when the economy is expanding, we turn to periods of real growth deterioration. As previously mentioned, this approach includes both recession and economic slowdowns, allowing us a more broad-based assessment of the potential impact of downside growth outcomes on our investment approach. Macro strategies typically shine during these periods in terms of relative performance, but we also would require to see positive absolute performance to evaluate the independence of our strategy from growth:

As we can see, our simulated Alpha Strategies have provided consistently provided positive expected returns during growth decelerations.

Alpha Strategies: Macro Regime Return Study

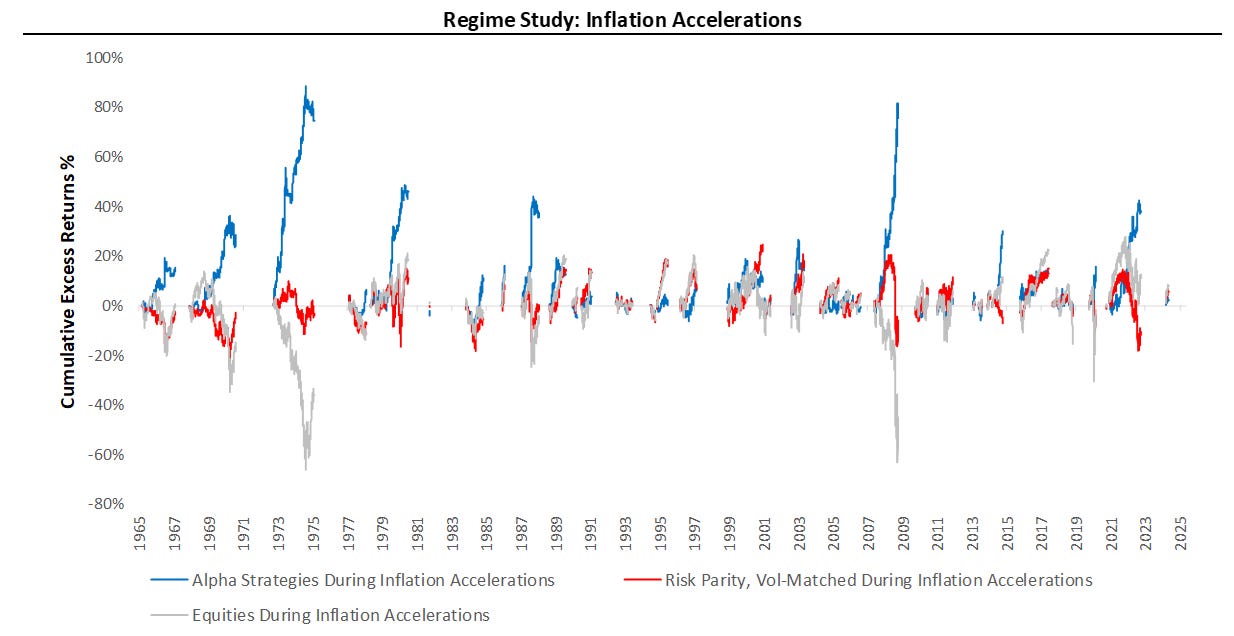

We now turn to one of the biggest blind spots from traditional asset allocations (stocks & bonds), periods of accelerating inflation. While introducing commodities offers some respite to stock and bond investors, persistent inflationary environments can cause pressures even on Risk Parity portfolios, depending on their structure. As such, a crucial evaluation of macro alpha is an assessment of whether our strategies are impervious to periods of inflation. We the cumulative returns of our simulated strategy during these periods below:

As we can see, our simulated Alpha Strategies have provided consistently provided positive expected returns during inflation accelerations.

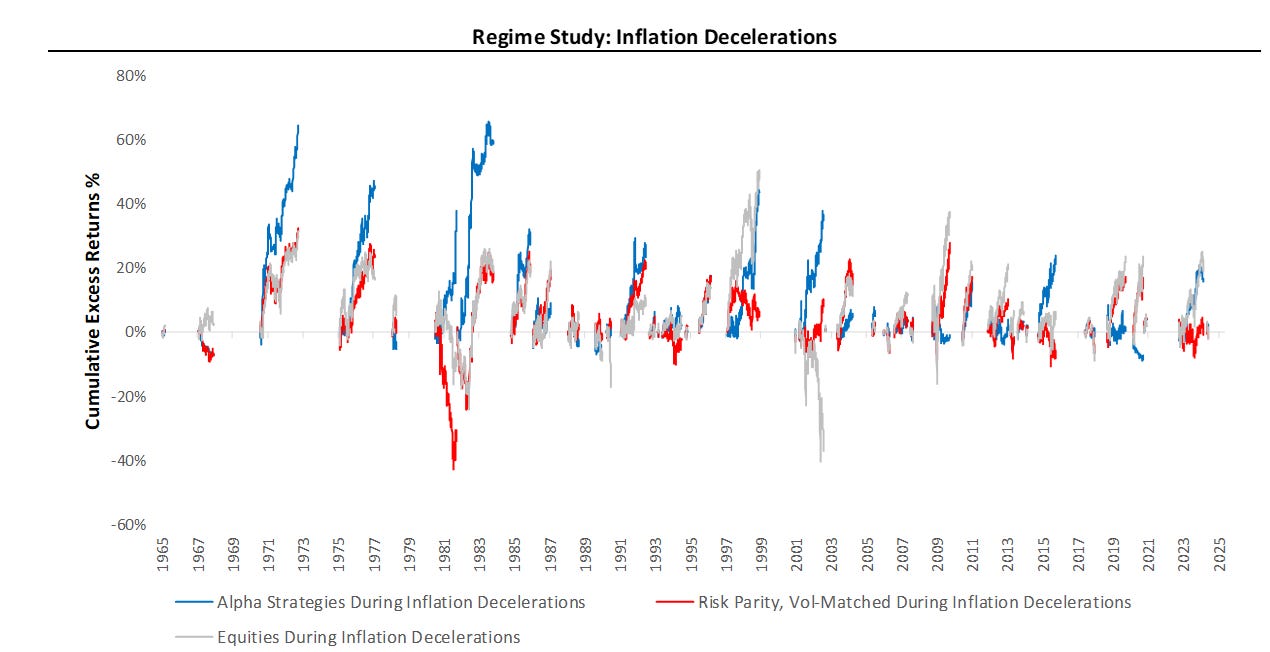

Alpha Strategies: Macro Regime Return Study

Finally in our macro regime study. We turn to the cumulative returns of our Alpha Strategies during periods of falling inflation. Much like rising growth periods, low inflation has been beneficial to Risk Parity portfolios and Equities, while deflationary pressures have weighed on Equities, but benefitted Risk Parity. We once again compare the performance of our Alpha Strategies to these benchmarks to asses our exposure to disinflation:

As we can see, our simulated Alpha Strategies have provided consistently provided positive expected returns during inflation decelerations.

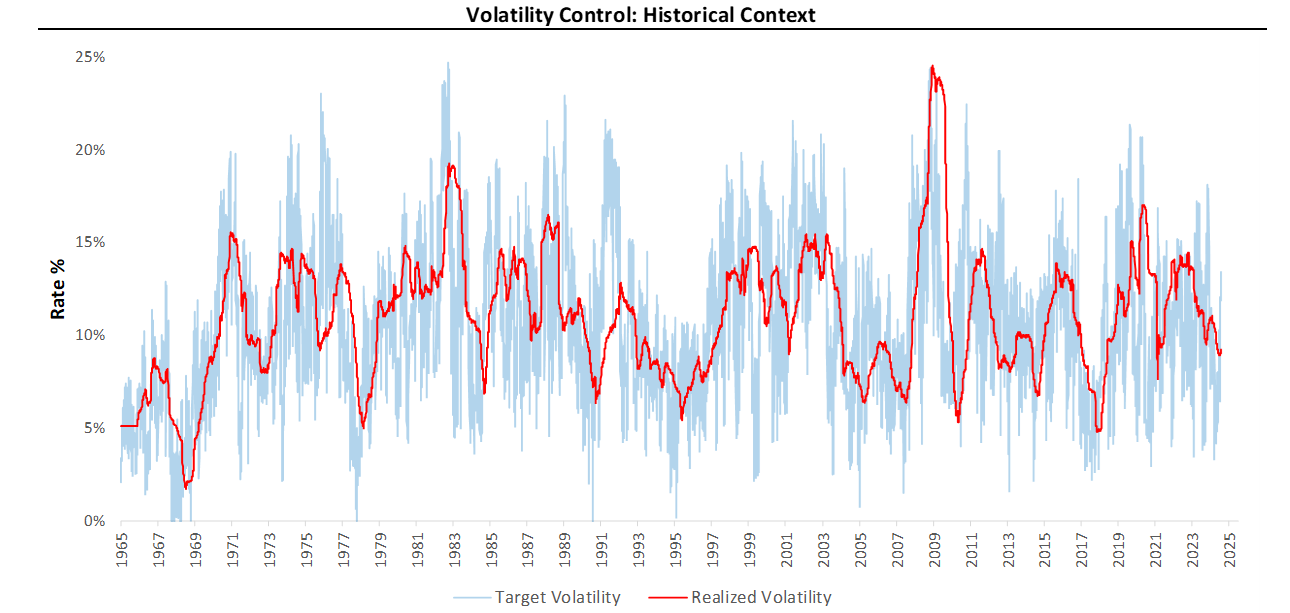

Alpha Strategies: Volatility Control

Now that we have examined the returns of our strategy., we now turn to the risk realized to achieve these returns in the form of volatility. While our signal generation process generates our convictions for each position, it is our volatility control that determines our gross exposure for our total portfolio. Our volatility target is dynamic, aiming to achieve long-term volatility consistent with Equities, but varying over time as the investment opportunity set changes. Below, we show how our target volatility has been a good barometer of our realized volatility, allowing us to effectively manage risk ex-ante.

This volatility control is essential in controlling portfolio drawdowns, which we turn to next.

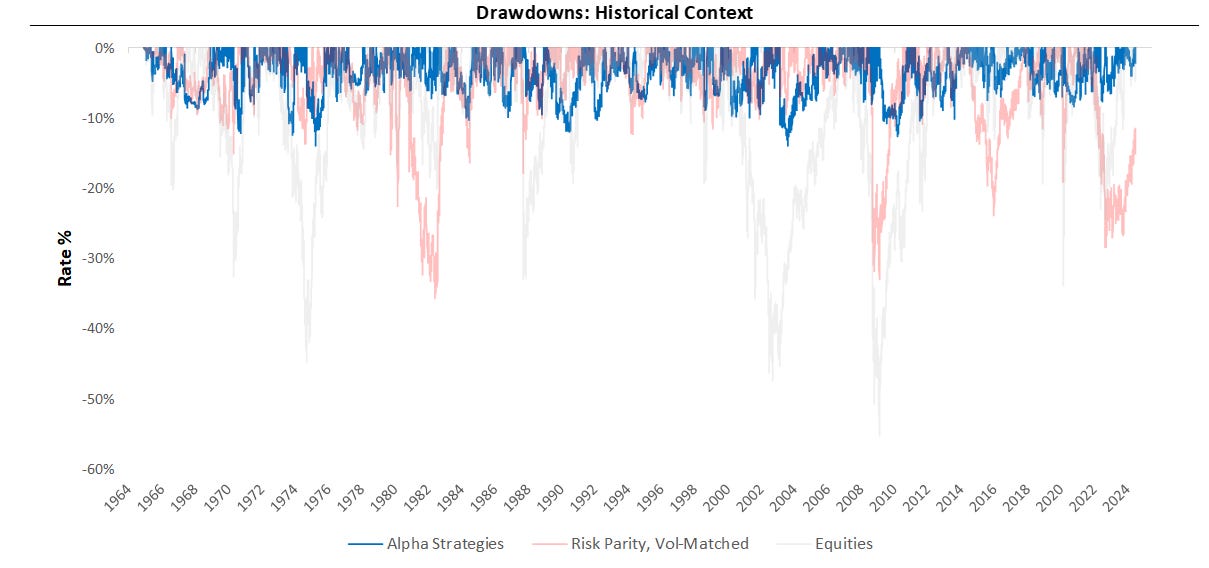

Alpha Strategies: Drawdowns

Now that we have examined the returns & volatility of our strategy, we now turn to the path-dependent risk in the form of drawdowns. Drawdowns are a function of the hit rate of a strategy, coupled with the risk taken. Managing drawdowns allows a strategy to maintain a higher capital base upon which to compound, creating better geometric returns over time. We contain drawdowns by dynamically varying the risk based on the existing opportunity set, our volatility control, and our current level of losses. We visualize the outcome of this process below:

As we can see above, the maximum drawdown of the strategy has been 14%, with our Beta Portfolio and Equities seeing drawdowns of many multiples of this number. While at times the drawdowns of the strategy do exceed those of the Beta Portfolio, these drawdowns remain well within expected drawdown bounds and consistent with the level of risk taken by the strategy.

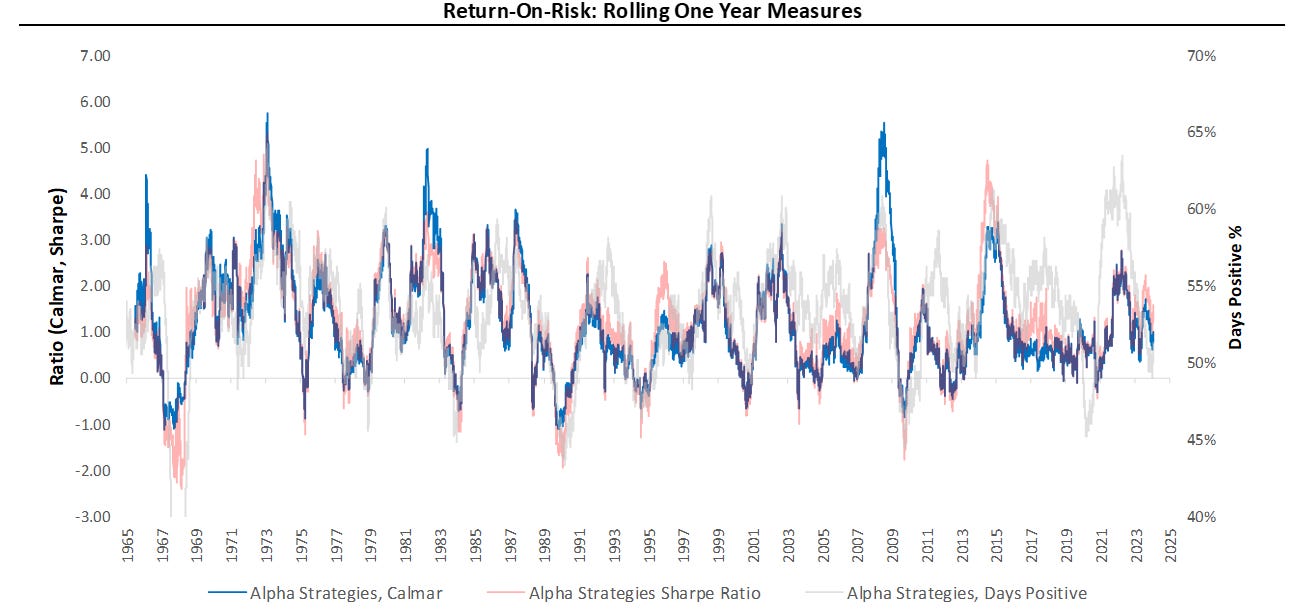

Alpha Strategies: Return On Risk

We now combine risk and return measures to understand the return per unit by examining our Calmar Ratio, Sharpe Ratio, and Days Positive Ratio (over cash). All three of these measures have their benefits. The Calmar Ratio best assesses a portfolio's practical return to risk characteristics, rewarding excess returns, and penalizing drawdowns. The Sharpe Ratio allows an additional perspective by accounting for the amount of variance taken to achieve a given level of returns. Finally, examining the Days' Positive Ratio lets us understand whether our strategies benefit from asymmetric payoffs or consistently making the correct bets. We visualize this below on a rolling one-year basis to examine trends.

As we can see above, all these risk-adjusted return measures have remained healthy over the decades.

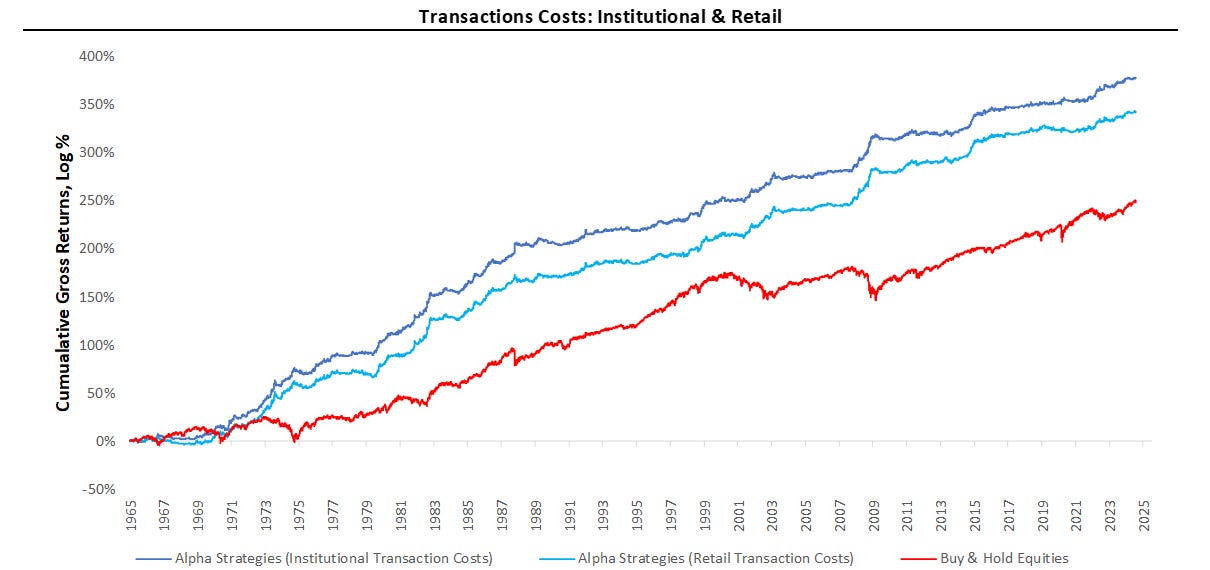

Alpha Strategies: Transactions Costs

Thus far, our discussion has been for our strategy performance gross of transaction costs. This is because transaction costs for the end user can vary dramatically- large institutions have access to the best-in-class execution and often employ capital-efficient expressions such as futures and options. Investment advisors, family offices, and individual investors may lack access to these tools, limiting them to ETFs. This divergence leads to dramatically different transaction costs. We estimate that a highly efficient program may be able to deploy our strategy with a 0.05% cost per unit of notional traded. On the other hand, an ETF-based investor may incur costs significantly higher than that, according to our estimates, at about 0.15% cost per unit of notional. These assumptions are conservative to allow room for error. Given that our strategies capitalize on large macroeconomic moves, we think our alpha Strategies will add value to all investor cohorts but require adjustments depending on the end user. We show how making adjustments to our signalling process can bridge this gap:

Alpha Strategies: Conclusions

Alpha Strategies reflects the best parts of our understanding of macro, markets, and portfolio construction. The purpose of Alpha Strategies is simple: to provide durable and consistent return streams independent of beta. These strategies span equities, fixed income, and commodities, combined into a single portfolio accessible exclusively to Prometheus institutional clients. These signals will be provided daily in our upcoming Alpha Strategies report, including our latest positions, recent returns, ex-ante portfolio risk, and assorted proprietary macro gauges. The Prometheus Alpha Portfolio is designed with the following investment principles:

Achieve a high return-to-risk ratio over a long-term time frame, independent of the performance of beta.

Maintain a volatility consistent with the long-term volatility of equity markets.

Control drawdowns to continuously compound capital from a higher base.

Our simulations from 1965 to the present have shown that our approach has largely been independent of beta, with strict risk management. This combination is likely to provide strong risk-adjusted returns over time. Finally, we show how our signals, which largely bet on macroeconomic outcomes, apply to both institutional and retail investors, even after accounting for transaction costs. Overall, Prometheus Alpha Strategies is the culmination of years of engaging in our iterative research process, and while we will continue on this path of constant evolution, this is a big step forward. We are extremely excited to begin sharing all that we have built.

1. How to subscribe?

2. Will your provide API for this?