This report is part of our ongoing effort to provide economic and market guidance to our subscribers during a period of historic levels of uncertainty. This note aims to share our research team's internal checkpoint process in evaluating the current state of the economy as it pertains to markets. The pages that follow will have familiar content for those who follow our work, but with the added benefit of our connecting the dots across all the economic and financial data our systems use to make portfolio decisions. Our primary takeaways are as follows:

Nominal activity has decelerated, with real growth contracting and inflation decelerating. These moves aligned with our expectations and reflected the slowing of the labor impulse to broader activity.

Alongside this contraction in real activity, we saw significant stress in the banking system as the cumulative impact of tightening policy liquidity flowed through to financial intermediaries. We are now moving into the part of the cycle where public and private sector liquidity are likely to contract in unison. This path bodes ill for future nominal activity.

Our systems have now confirmed recessionary conditions. We see equity markets as particularly exposed to this risk, which our cycle strategies will look to exploit.

In this issue, we will begin to weave in our systematic expectations for markets as part of our Month In Macro offering. In this edition, we will be mainly focused on the real growth outlook. Additionally, this edition will be relatively concise relative to our typical publications- the team has just returned from a much-needed break and will return to regular publishing this month. Now, let's dive in.

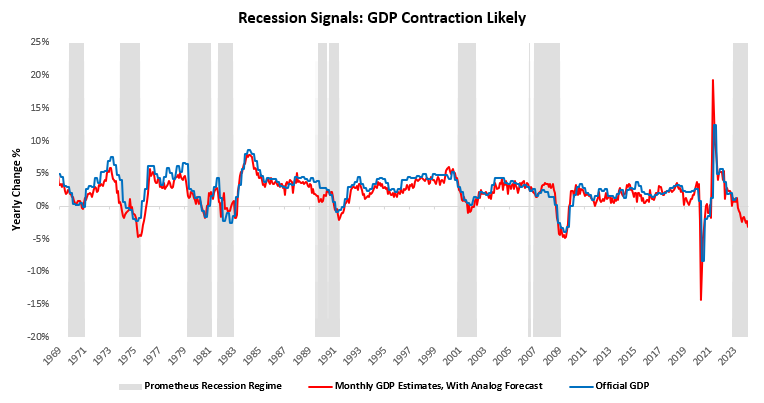

As noted in our headline takeaways, our systems now place the economy in a recessionary regime:

Based on our estimates, GDP will enter a contraction in H2 of this year, creating an opportunity for our Prometheus Cycle Strategies in equity markets.

Prometheus Cycle Strategies: Real Growth

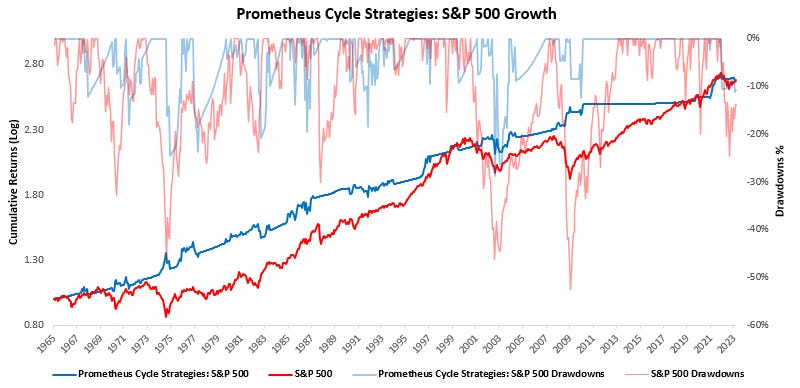

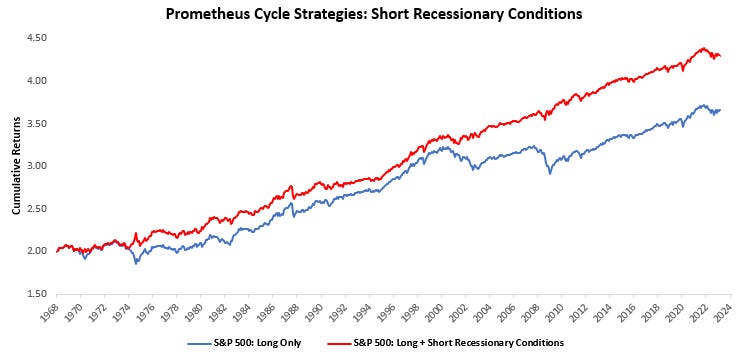

Our Month In Macro report aims to offer a granular and comprehensive understanding of current economic conditions and how they will likely evolve- to help investors navigate markets through the economic cycle. To augment the research and analysis, we have developed Prometheus Cycle Strategies- which use our cyclical expectations to trade markets. These Cycle Strategies reflect the understanding that particular points in the economic cycle offer an asymmetrically positive return on risk, either long or short assets. Using our systematic process, we attempt to forecast these points to harvest these attractive return-to-risk characteristics. Below, we show the first of the Prometheus Cycle Strategies- which trades the equity market based on our real growth forecasts:

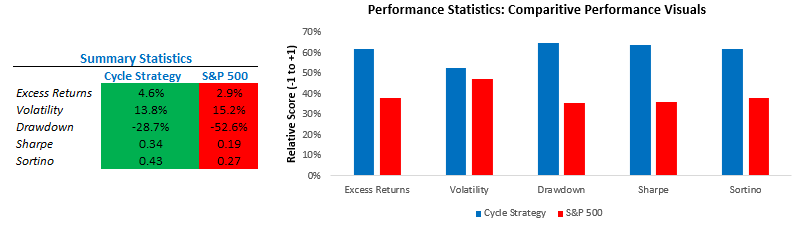

The strategy above seeks to short equity markets as we head into an impending recession and go 2X leveraged long equity markets during recoveries; otherwise, it remains in cash, with monthly turnover. As shown above, the system performs well, outpacing equity returns with smaller drawdowns. Importantly, it does so with minimal market exposure- with a beta of 0.1. Said differently, this strategy outperforms the equity market while exposed to market risk less than a third of the time. This performance reflects our understanding that there are particular points in the economic cycle where an asset offers a significantly higher return on risk than during other periods. Harvesting these returns can lead to significant outperformance. Below, we show some summary statistics:

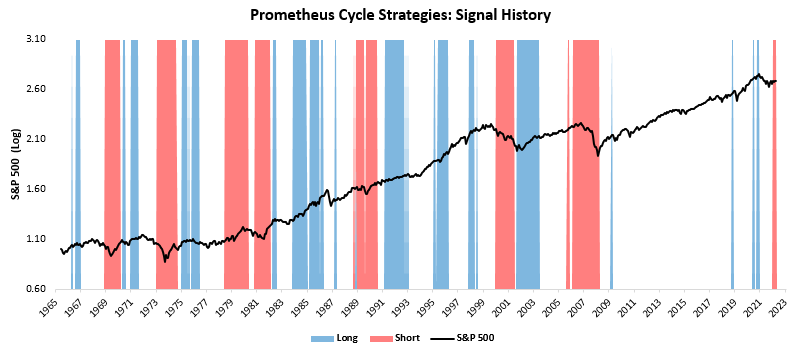

In the case of equities, this pay-off profile can be obtained by shorting stocks as we move into a recessionary environment and buying them as we emerge and move into an economic recovery. These turning points in the economic cycle offer some of the most substantial return-on-risk opportunities, both long and short. Below, we show the signal history of the strategy:

Above, we note two features. First, the strategy has no directional bias, i.e., no hidden beta. Second, the strategy did not trigger for nearly a decade as cyclical conditions did not warrant a recession or a recovery. Nonetheless, gains made from prior cycles allowed the Cycle Strategy to remain ahead of equities. This Prometheus Cycle Strategy has turned bearish on the S&P 500 as our systems now expect a recession. Even if we do not achieve a recession, we find it highly likely that we will achieve a further profit contraction. This weakening of cashflows will likely mean more equity weakness ahead as markets have priced neutral growth outcomes in 2023. We think it is important to take heed of this message, even if maintaining beta exposure is the objective. Below, we show how only taking the short signal in addition to long S&P 500 exposure has been highly additive to performance:

Therefore, even if you are a long-only investor, the bearish outlook of our systems implies that the forward-looking returns on equities will be weak at best and significantly negative at worst. The strategy is in a bearish regime but positioned flat. To protect our edge in markets, we do not share our signal construction; however, we share the logic driving our systems' expectations over the pages that follow.

Until next month.

excellent as always, I appreciate your work and sharing

Your economic cycles model is in alignment with our dynamic time cycles model. Keep up the good work. I will recommend your blog!