As part of the Observatory, we track a vast range of economic data to assess where we are in the economic cycle. We aggregate data and their expectations into six key areas: Risk Premia Labor Markets, PMI Surveys, Production, Real Estate, and Incomes & Spending. Additionally, we aggregate the most high-frequency data (weekly/daily) to feed our investment machine, allowing us to nimbly adjust our views on the economy and thus change positions.

Summarily, the data shows that faster moving and leading data has already deteriorated; the question is whether slower moving and lagging data will move to corroborate these decelerations and lead to a broad-based decline. In particular, signals from asset markets, real estate, and incomes have shown significant slowdowns. Additionally, PMI data have begun their descent, and our systems estimate there is a likelihood they will deteriorate further. Finally, production and employment data continue to remain elevated. Archetypically, these divergences between data aggregates are common at turning points in the economic cycle, with leading indicators slowing before lagging components. We wait and watch.

Let’s take a look at these aggregates one by one.

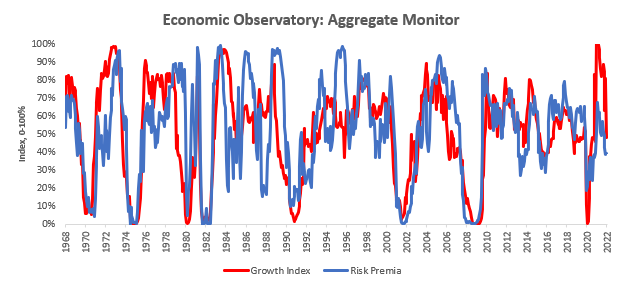

Risk Premia

Asset markets offer a high-quality and high-frequency signal about the economy's underlying strength. Furthermore, they also have impacts on economic outcomes via the wealth effect. We aggregate some of the best measures to get a sense of what Risk Premia are telling us about the economic cycle:

As we can see above, asset markets are discounting a slowing growth impulse and have done so since late last year.

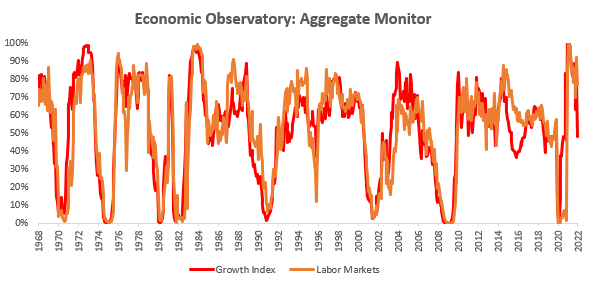

Labor Markets

Labor markets are a critical variable in assessing economic growth. While, indeed, labor markets do not offer any significant forecasting insight, they allow us to get a robust and granular sense of the current economic environment:

Labor Markets continue to show above trend strength. As is typical, Labor Markets tend to react to slowing earnings, PMI, and economic outlook and are rarely a leading indicator of a slowdown. In assessing slowdown risk, we will continue to look for deteriorations in the labor market to confirm a broad-based slowdown.

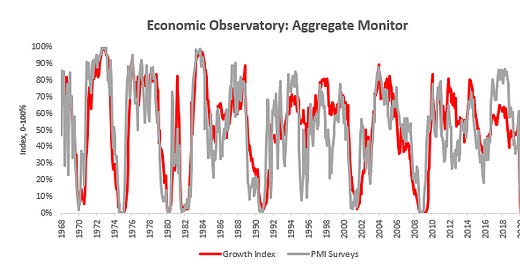

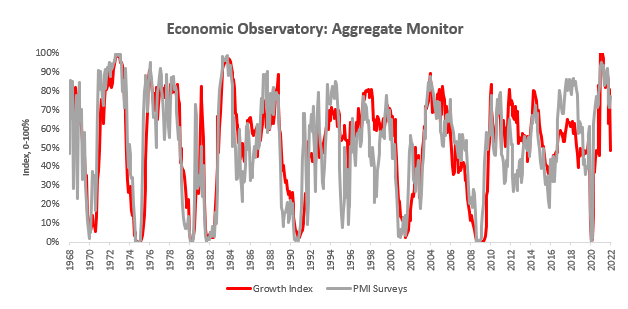

PMI Surveys

PMI surveys offer our systems a timely and often leading economic indicator set. While not as high-frequency as markets, they are subject to considerably less volatility allowing for more stable estimates.

PMI surveys have begun their descent, and our systems estimate there is more to come. This PMI slowdown creates a problematic backdrop for corporate profits and risk asset performance.

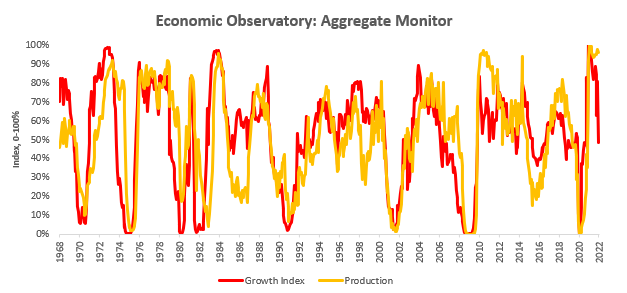

Production

Production components are vital in assessing the health of the business and manufacturing sector of the economy. These segments tend to be highly reactive to credit conditions and the economic outlook.

Production remains robust, consistent with the inventory build we have seen recently in the manufacturing sector. Increased inventory build only temporarily supports growth and without accompanying income & expenditure expansion, this above-trend state is likely trasnient.

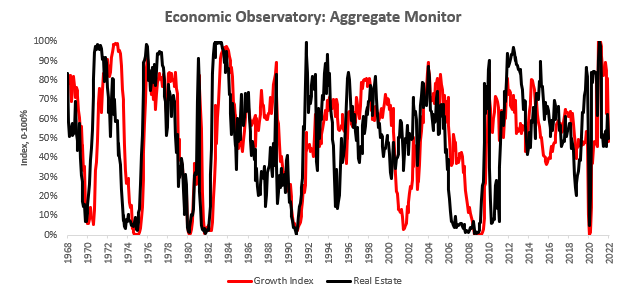

Real Estate

Much like Risk Premia, Real Estate has significant ramifications for the business cycle through the wealth effect channel. The leading relationship between the real-estate sector and consumer spending is well documented and, therefore, a critical variable in assessing growth.

The COVID-19 crisis led to a significant spike in our real-time tracking of Real Estate markets, but this burst of vitality looks temporary. Declining Real Estate activity will likely weigh on future economic activity.

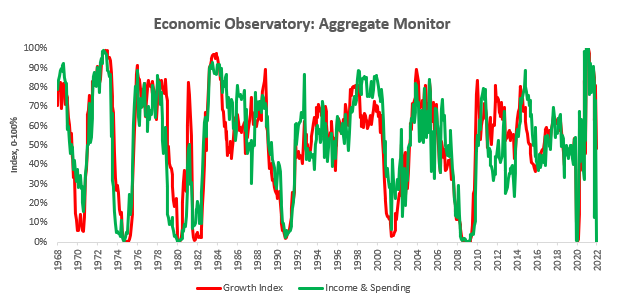

Income & Spending

Consumer incomes & expenditures are the most dominant feature of the US economy, powering most economic growth. We carefully dissect and analyze consumer data to understand where we are in the cycle.

After the massive impulse to consumer balance sheets from the fiscal transfers last year, consumer incomes have deteriorated significantly alongside high inflation levels. The lack of sustained income expansion is one of the critical features powering the current slowdown.

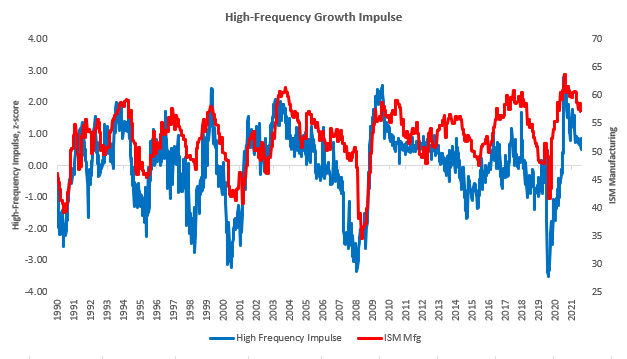

Conclusions: Early Stages of Slowing

Our systems estimate we are in the initial slowdown stages, and there is still substantial room for conditions to deteriorate. Components of the growth complex confirm the slowdown, but some remain resilient.

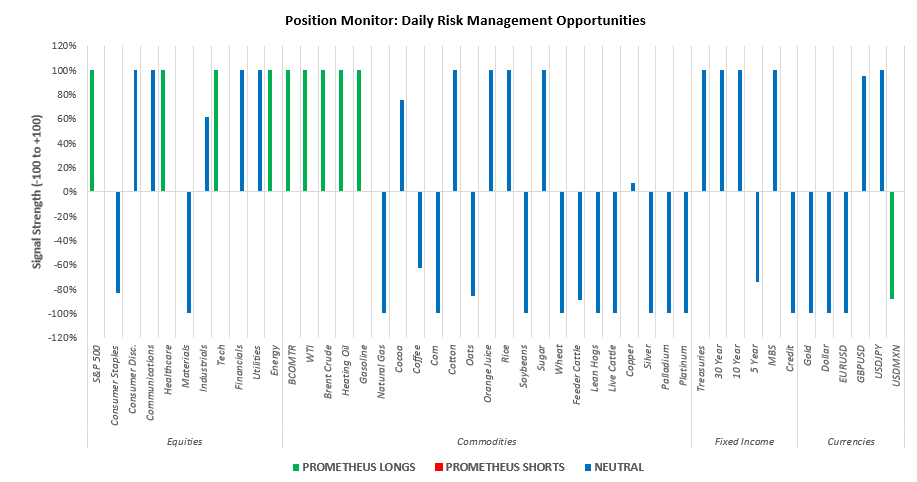

Our High-Frequency Growth Impulse has yet to enter negative territory, which would initiate broader short positions in Equities & Commodities. This path seems probable, but the future remains dynamic, and we continue to adjust as new information is available. For the time being, here is how we are positioned this week:

The Prometheus Alpha Strategy is LONG: S&P 500, Healthcare, Tech, Energy, BCOMTR, WTI, Brent Crude, Heating Oil, Gasoline, USDMXN.

Our Beta Rotation Strategy is currently LONG: Commodities.

A Market Regime Portfolio would be allocated to Stocks: 8.4%, Commodities: 57.3%, Treasuries: 0%, Gold & TIPS: 7%, Cash: 27.6%.

Stay nimble!