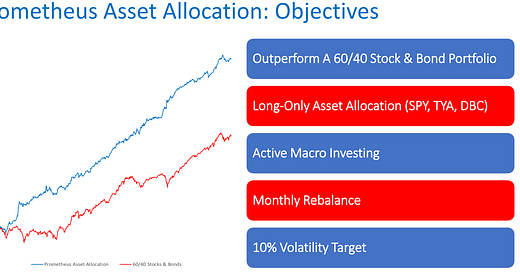

The Prometheus Asset Allocation program offers a stable, macro-focused approach to asset management. Prometheus Asset Allocation aims to outperform a traditional stock and bond portfolio by leveraging our proprietary systematic macro process to rotate between 3 ETFs monthly (plus cash).

Our key takeaways are:

Macro Monitor: Despite a high degree of market volatility, markets have once again moved to confirm an economy that is Slowing But Growing. Data has largely remained positive, though the breadth of GDP data has somewhat weakened. We see more slowing ahead, as inventory data is currently supporting a spike in GDP measures. Looking to Q4 2024, our systems are expecting annualized nominal GDP growth of 3.5% in Q4, down from 3.8% in the prior quarter. The manufacturing economy remains under pressure, which supports the ongoing slowing of the economy.

Asset Allocation: Our Asset Allocation program saw gains of 1.1% last month, as stocks and bonds both performed well. Consistent with our systematic fundamental outlook, the Prometheus Asset Allocation Strategy is currently positioned long SPY (35%), flat TYA (33%), flat DBC (0%), and Cash (33%). This allocation is consistent with a long-term expected volatility of 10%. The major change is the shift out of commodities. Macro conditions now look consistent with slowing nominal GDP growth, with inflation trending towards the Fed’s 2% objective. This backdrop of macro stability is favorable for stocks and bonds, but not for commodities- which is reflected in our portfolio positions.

You can access the full note below:

Additionally, the video can be accessed below:

Not sure if I commented here yet or not, but this video was outstanding. Great work!