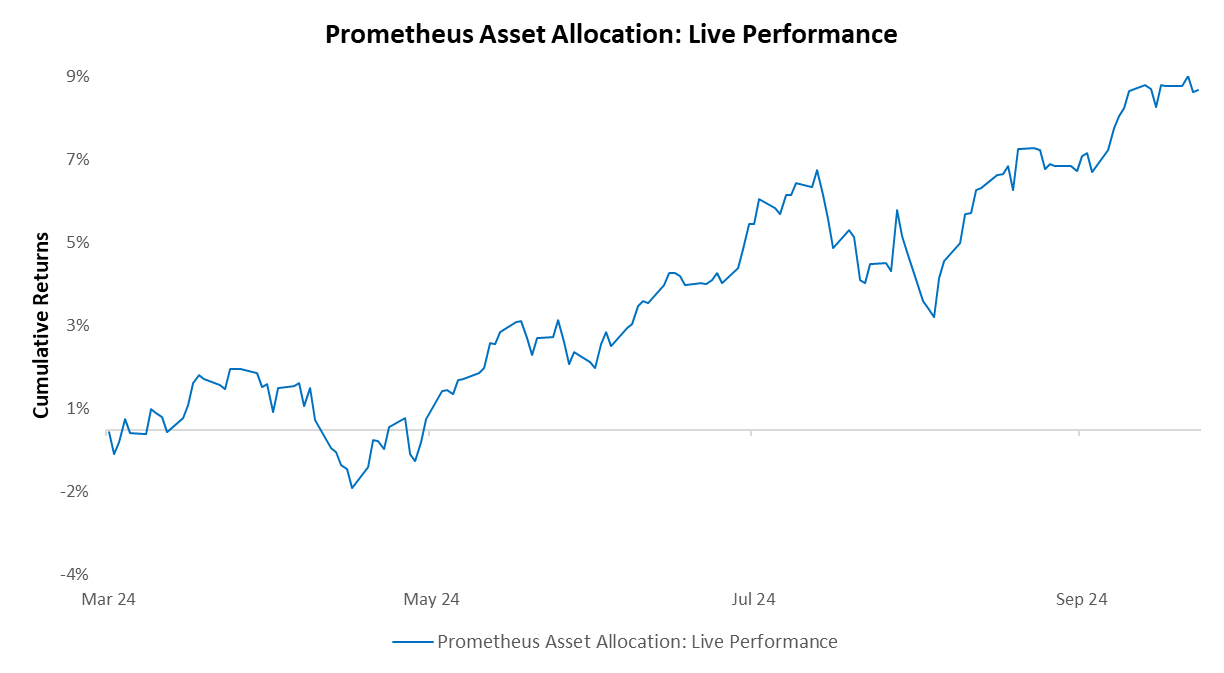

The Prometheus Asset Allocation program offers a stable, macro-focused approach to asset management. Our live performance continues to operate in a manner consistent with these objectives:

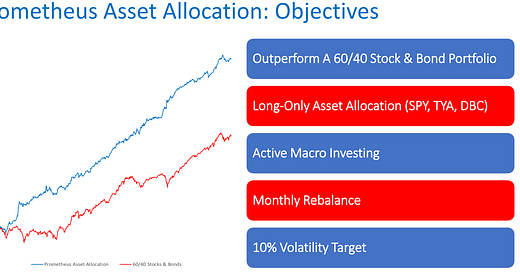

Prometheus Asset Allocation aims to outperform a traditional stock and bond portfolio by leveraging our proprietary systematic macro process to rotate between 3 ETFs monthly (plus cash).

Our key takeaways are:

Macro Monitor: Markets continued to see significant volatility over the last month, particularly driven by a near-outlier event in the form of the Fed easing more than was priced into short-term interest rate markets. This easing of policy resulted in strong outcomes for stocks and bonds in September. Commodities were flat on the month, with weakness in the first half of the month, only to rebound as a potential reflationary regime began to be priced in. While markets are now focused on a potential Fed-induced reflation, our programmatic process continues to suggest the economy will remain in a regime of Slowing But Growing.